USD/JPY – 109.52

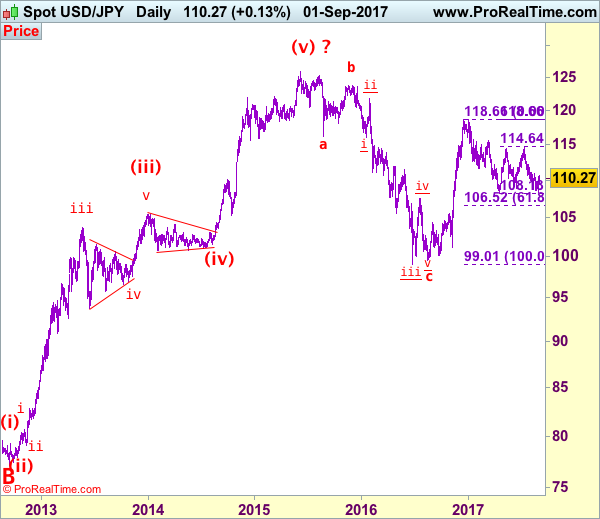

Although the greenback fell briefly to 108.27, as dollar has rebounded quite strongly after holding above this year’s low at 108.13, suggesting early downtrend is not ready to resume yet and further consolidation above this level would be seen, hence another bounce to 110.95 resistance cannot be ruled out, however, break there is needed to add credence to this view, bring retracement of recent fall to 111.35-40 (50% Fibonacci retracement of 114.50-108.27), then towards 111.70-75, however, reckon upside would be limited to resistance at 112.20, bring another decline later.

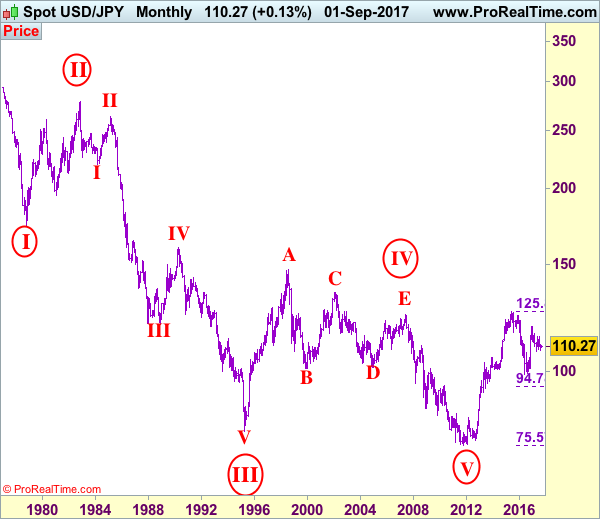

Our preferred count is that, triangle wave IV (with circle) ended at 101.45 and the circle wave V brought dollar down to the record low of 75.31 in 2011 and the subsequent rebound signal major correction has commenced with A leg ended at 84.19, followed by wave B at 77.14 and impulsive wave C is now unfolding (indicated upside target at 125.00 had been met) for gain towards 127.00 level. In the event dollar drops below support at 99.01, this would confirm medium term decline from 125.86 top (2015 high) has resumed for subsequent weakness to 98.00 and possibly 97.00.

Under this count, this wave C is unfolding as impulsive waves with (1) (2), 1 2 ended at 80.67, 79.07, 82.84 and 81.69 respectively, hence the extended wave 3 has ended at 103.74 and wave 4 correction of recent upmove should bring weakness to 92.57, then towards 90.88 but psychological support at 90.00 should limit downside and bring another rally later in wave 5, indicated target at 125.00 had been met and gain to 127.00 cannot be ruled out but reckon price would falter below 130.00.

On the downside, whilst pullback to 109.80-90 cannot be ruled out, reckon Friday’s low at 109.55 would limit downside and bring another rebound later. A daily close below this level would risk weakness to 109.00, however, reckon said support at 108.27 would hold, bring another rebound later. Looking ahead, only a drop below support at 108.13 (this year’s low) would extend early decline from 118.66 top to 107.50, then 107.00, having said that, reckon 106.50-55 (61.8% Fibonacci retracement of 99.01-118.66) would limit downside and price should stay above 105.00 psychological level.

Recommendation: Sell again at 112.00 for 110.00 with stop above 113.00 or buy at 109.70 for 111.70 with stop below 108.70.

On the monthly chart, we have changed our preferred count that an impulsive wave is unfolding with major wave III with circle ended at 79.75, then followed by wave IV with circle and is labeled as a triangle with A: 147.64 (11 August, 1998), B: 101.25, C: 135.20, D: 101.67 and E leg ended at 124.14 to end the wave IV with circle. Hence, wave V with circle commenced from there and hit a record low of 75.31, however, the subsequent strong rebound signals this circle wave V has possibly ended there, hence gain to (indicated upside target at 122.00 and 125.00 had been met), the retreat from 125.86 suggests wave A of major correction has ended there and wave B correction back to 99.00, then 95.00 would be seen, however, reckon downside would be limited to 90.00, bring another rebound in wave C next year.