ENERGY

Crude oil was among top losers last week, on fall of nearly 10%. WTI oil returned below psychological $50 per barrel support for the first time since early Dec 2016. Strong sell-off was triggered by record build in crude oil stocks which rose by 8.2 million barrels previous week, compared to forecasted build of 1.1 million barrels.

Also, increased oil production in the US that raises doubts on global production cuts, agreed last year on OPEC-led meetings, sidelines expectations of oil price increase and intensifies fears of further fall of oil prices, threatened by global oversupply.

Last week’s fall also broke some strong technical supports, increasing risk of further easing, as bears hit 50% of mid-Nov/early Jan $42.19/$55.22 recovery rally, turning risk towards $47.00/$45.00 zone in the near-term.

Broken $50 support now acts as initial resistance that keeps so far mild recovery attempts limited and maintains negative outlook.

Brent oil was tracking WTI movements and showed similar reaction on fall from week’s high at $56.62 to fresh 2 ½ month low at $51.50, losing nearly 7% for the week, the biggest weekly fall since the last week of Oct. Technical studies suggest that further weakness could be anticipated after the price broke below strong supports at $53.15 and $52.30.

Correction of last week’s strong fall could be expected on profit-taking, but overall bearish bias is expected to persist. Initial resistance at $52.30 is followed by $53.15/45, with extended recovery not to exceed $54.60 resistance.

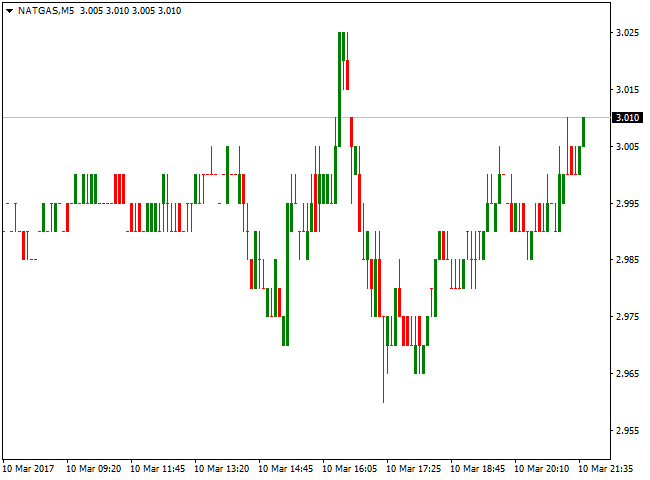

Natural gas extended recovery for the second straight week and approached strong Fibonacci 38.2% resistance at 3.042, after denting 200MA barrier at 2.964. Gas price is on track for the second weekly bullish close that signals further recovery. Next technical barriers lay at 3.130 and 3.205. Correction should be ideally held above 2.80 to keep fresh bullish momentum intact.

COMMODITIES

Spot gold remained strongly in red for the second week and probed below psychological support at $1200 last week. Markets are very confident in US rate hike on Fed’s meeting next week that keeps the yellow metal under increased pressure. Investors are worried that scenario from last Dec, when Fed increased rates after one year and Gold fell to 10-month low, could repeat this time. Gold is on track for the second strong weekly fall that marks total loss of over 4% since previous bull-leg stalled at $1260 zone. Also, strong signals that the US economy is recovering encourage gold sellers.

However, traders think that Gold loss might be limited despite strong pressure on rate hike expectations, as political uncertainty in Europe and USA, as well also tremors that come from Far East, may keep Gold’s safe-haven appeal in play. Bearish technicals studies work in favour of sellers, suggesting that corrective upticks should be ideally capped at $1212 zone and extensions not to exceed $122 barrier, to keep bearish outlook in play.

Spot silver was down over 5% for the week and extended weakness from $18.47, late Feb recovery high, to hit levels below $17.00 per ounce. Negative sentiment that hit precious metals was sparked was sparked by strong expectations for Fed’s rate hike and may persist as solid US data released recently, support Fed’s decision to start tightening the policy from Q1 2017.

Technicals turned into negative mode and suggest further weakness that may extend towards next technical supports at $16.70 and $16.30.

On the upside, $18.40 and $18.88 levels mark good technical barriers that are expected to cap.

Coffee C contract for May ended week in red after trading within $144.30 and $139.60 range and repeated failure to sustain repeated break below psychological $140.00 support. The price closed above strong technical support at $141.20, keeping the downside protected for now, as two strong supports at $140.00 and $139.60 are seen as key levels, break of which could trigger further easing. Technical studies remain bearishly aligned and would keep risk shifted lower, after Friday’s close below another pivotal support at $142.00.

Copper contract for May fell sharply last week, losing around 3.5% on dip to 2.5580, the lowest price since early Jan. Strong sell-off was triggered by profit-taking on long positions as investors were concerned that markets had decent supplies, despite strikes and export ban that reduced production in two biggest mines in Chile and Indonesia and plans for another strike in mine in Peru. In addition, copper inventories soared by 74%, offsetting support expected from possible production shortage on strikes. Copper price recovered mildly on Friday, bouncing from weekly low at 2.5580 to the levels above 2.6100. Technical studies remain weak after last week’s fall and see potential for further price easing, with investors investors expected to stick to ‘buying the rumours selling the fact’ scenario.

INDICES

Wall Street ended up on Friday after solid US jobs data signalled further economic strength and supported expectations the Federal Reserve will raise interest rates next week. Indexes ended lower for the week, however, with the S&P 500 and Nasdaq breaking a six-week streak of gains. DOW Jones closed at 20888 for the day, marking the second consecutive bullish daily close, but weekly close was in red for the first time since mid-Jan.

S&P500 followed, closing at 2371, on the second consecutive bullish daily close but weekly close was in red.

UK’s FTSE100 managed to recover ground, closing on Friday at 7345, on bounce from weekly low at 7245 after strong reversal signal, generated during the week. Fresh bullish sentiment is turning focus again towards record high at 7382.

Nikkei 225 closed on Friday at 19440, extending recovery os Thu/Fri that managed to recover the largest part of losses made earlier this week. Technical studies remain bullish overall and keep focus at the upside, after last week’s easing was contained by strong technical support at 19.50

FOREX

The two key events highlighted the week behind us: ECB policy meeting and US jobs data. The US dollar showed mixed reaction on these events. After the European central bank left rates unchanged, as widely expected, traders turned focus on comments from central bank’s president Mario Draghi.

He commented current situation in the Eurozone, with focus on inflation and QE program that was closely monitored by traders. Economic situation in the bloc is still requiring ultra-low rates, despite inflation showed signs of picking up and raised ECB’s inflation projections, political risks on coming elections in Netherlands and France, need to be considered.

Other important subject was QE program, as investors expected Draghi to give more signals of tapering, as announced earlier. ECB president said that current situation needs further bond-buying but this would be gradually reduced during the year. Markets saw this comment as hawkish and Euro jumped on fresh positive sentiment.

The EURUSD recovered all losses made during the week on fall from 1.0640 to 1.0525 and spiked to 1.0700 in late Friday’s trading. Strong technical resistances were taken out and near-term bias turned higher.

The Euro’s rally was supported by weaker dollar that was disappointed after solid US jobs report was weakened by lower than expected rise in US wages in February. The dollar has failed to appreciate overall solid jobs report that is expected to help Fed in making decision on next week’s monetary policy meeting.

GBPUSD ended the second week in red, remaining under strong pressure on Brexit concerns, but showing hesitation at important support at 1.2155, which was dented but without clear break. However, strong negative sentiment persists as markets are awaiting next week’s continuation of parliament’s meetings regarding conditions of starting official divorce process.

The pair remained unaffected by today’s US data and trading within narrow range for past two days.

Consolidation is likely to precede fresh weakness that may extend towards 2017 lows at 1.2000 zone.

USDJPY was dragged lower after release of US jobs data, failing to fully capitalize on last week’s strong rally that peaked well above 115.00 mark. Strong bullish technical signals that were generated during the week, pushed traders into dollar longs, but the pair’s rally stalled at 115.50 on Friday and pullback after US data that slightly upset dollar’s bulls, resulted in close below 115.00 handle. The price may spend some time in consolidation, ahead of next week’s top event, FOMC meeting that is seen as next strong market driver.

USDCAD eased on Friday after the greenback was pulled lower on US jobs report and Canadian dollar appreciated better than expected domestic jobs data that offset risks to the economy from an uncertain outlook. The pair fell to 1.3420 on Friday, pulling back from Thursday’s multi-week high at 1.3534.

However, outlook for the short term remains bullish on expectations of US rate hike and supported by positive technical studies. Correction could extend down to 1.3300/1.3200 zone, before bulls resume.