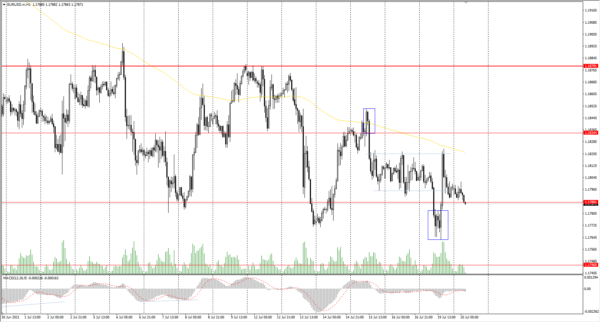

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1802

Prev Close: 1.1798

% chg. over the last day: -0.03%

The ECB has slightly reduced the pace of asset purchases, while the US Fed, on the contrary, started buying assets more aggressively, despite talks about possible cuts in the QE program. Taking into account that there is no acceleration in inflation in Europe, this situation plays in favor of a stronger euro.

Trading recommendations

Support levels: 1.1788, 1.1746, 1.1609

Resistance levels: 1.1834, 1.1879, 1.1934, 1.1969

From the technical point of view, the trend is still bearish. Yesterday, the price broke through the lower border of the range and started to decline. But at the American session, there was a return back on the impulsive move. As a result, a false breakdown zone was formed, from which the buyers may look for buy deals, but only with short targets, as it will be trading against the trend. The MACD indicator is inactive. There are no optimal entry points for sell positions now.

Alternative scenario: if the price breaks through the 1.1879 resistance level and fixes above, the general uptrend is likely to be resumed.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3767

Prev Close: 1.3675

% chg. over the last day: -0.67%

The GBP/USD currency pair decreased sharply yesterday. This situation with the British currency was a surprise for traders, as there are no fundamental reasons for the pound to fall. The monetary policy remains unchanged, the economy is opening after the quarantine restrictions. But there is a slight acceleration in inflation.

Trading recommendations

Support levels: 1.3614

Resistance levels: 1.3690, 1.3756, 1.3805, 1.3899, 1.3923, 1.4002, 1.4075, 1.4101

The trend of the GBP/USD currency pair is bearish on the H1 timeframe. The MACD indicator went into the negative zone with no signs of reversal. Under such market conditions, traders are better to look for sell positions from the resistance levels. There are no optimal entry points for buy positions now, as buyers do not show initiative.

Alternative scenario: if the price breaks through the 1.3899 resistance level and consolidates above, the bearish scenario is likely to be canceled.

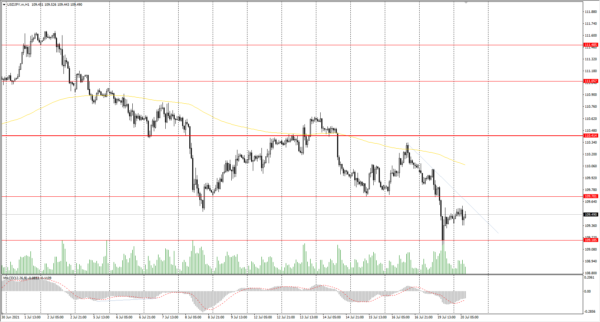

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 110.01

Prev Close: 109.45

% chg. over the last day: -0.51%

The Japanese yen futures strengthened yesterday, which caused a decline in the USD/JPY currency pair by 0.51% (inverse correlation). Even the rise in the dollar index could not affect the strengthening of the Japanese yen, which suggests that the Japanese economy is recovering. At the same time, the stock indices in Japan declined yesterday. The national consumer price index remained unchanged at 0.3%, but the core CPI increased by 0.2% in annualized terms.

Trading recommendations

Support levels: 109.19, 108.65

Resistance levels: 109.70, 110.41, 110.73, 111.06, 111.48, 110.73, 112.18

From the point of view of technical analysis, the situation has not changed. There is a downward trend on the H1 timeframe, as the price is still trading below the priority change level and the moving average. The MACD indicator is in the negative zone with no signs of reversal. Under such market conditions, traders are better to look for sell positions from the resistance levels on intraday timeframes. Buy positions should be considered from support levels, but only with short targets.

Alternative scenario: if the price rises above 110.41, the uptrend is likely to be resumed.

News feed for 2021.07.20

Japan National Consumer Price Index (m/m) at 02:30 (GMT+3).

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2604

Prev Close: 1.2746

% chg. over the last day: +1.12%

The USD/CAD currency pair added another 1.12% yesterday. The growth was caused by two factors: the dollar index and the oil prices. The dollar index is slowly growing, while oil prices just declined yesterday, which negatively affects the CAD.

Trading recommendations

Support levels: 1.26481, 1.2561, 1.2519, 1.2448, 1.2404, 1.2347, 1.2312

Resistance levels: 1.2787, 1,2951

Technically, the trend remains bullish. The price is growing steadily, and there isn’t significant resistance from the sellers. The MACD indicator is in the positive zone with no signs of reversal. Under such market conditions, it is better to consider intraday trading. Traders should look for buy positions from the support levels after a small pullback, as resistance levels are ahead and the price quite strongly deviates from the midline. There are no optimal entry points for sell positions right now.

Alternative scenario: if the price breaks through the 1.2561 support level and fixes below, the downtrend is likely to be resumed.