Dollar lost some momentum after yesterday’s sharp rebound, as markets are waiting employment data from US. Non-farm payroll report is expected to show 180k growth in August while unemployment rate is expected to be unchanged at 4.3%. Wage growth is also a key to watch and average hourly earnings are expected to rise 0.2% mom. It’s clearly that Fed will announce the plan to unwind its balance sheet later this month. The main question for all market participants is whether Fed will hike again this year. Fed fund futures are only pricing in 36.9% chance of another hike in December. Stronger than expected NFP numbers might lift the pricing a little. But Fed policy makers would still need to see evidence that inflation is back on track before making another move.

ECB Policy Stance Not to be Affected by Strong Euro

Euro suffered steep selloff yesterday on report that some "unnamed" ECB officials are concerned with its strength. And ECB might opt to "muddle" through the September meeting instead of announcing some solid tapering plan. However, we’d argue that recent strength is due to the unattractiveness of other currencies. For instance, US dollar’s weakness was broadly based, as US inflation has been stubbornly subdued. The White House chaos has raised concerns over a government shutdown in October, let alone the diminished hopes of pro-growth policies and tax reforms. Sterling is hardly a darling as the Brexit negotiation process appears slow and unproductive. While September may not be the timing for an announcement, the strength of Euro is unlikely to alter ECB’s stance. And the central bank will still conclude the tapering plan latest in October. More in ECB Policy Stance Not to be Affected by Strong Euro.

UK Fox hit back at EU Barnier

UK Prime Minister Theresa May and International Trade Secretary Liam Fox are still on trip in Japan that focuses on post Brexit trade between the countries. Fox hit back at EU chief negotiator Michel Barnier, who said that UK is being mired in "nostalgia" rather than taking a realistic approach in the Brexit negotiation. Fox said that "We can’t be blackmailed into paying a price on the first part". And, we think we should begin discussions on the final settlement because that’s good for business, and it’s good for the prosperity both of the British people and of the rest of the people of the European Union."

Barnier said after concluding the third round of Brexit negotiation that the UK proposals showed "a sort of nostalgia in the form of specific requests which would amount to continuing to enjoy the benefits of the single market and EU membership without actually being part of it".

Canadian dollar as best performer on rate bet

Canadian dollar was the best performer against the greenback, as strong GDP growth data intensified hopes of further rate hike later this year. Bets for a rate hike at the October BOC meeting increased after strong Canadian growth data. GDP expanded 4.5% saar in 2Q17, beating expectations of a 3.7% growth and marking the strongest expansion since 3Q11. Growth in the month of June decelerated to 0.3% mom, from 0.6% in the prior month. However, this came in better than consensus of 0.1%.

China PMI showed improved manufacturing sector

China PMI Caixin PMI manufacturing rose to 51.6 in August, up from 51.1, above expectation of 51.0. Caixin and IHS Markit noted in the statement that "companies expanded their production schedules and buying activity, while business confidence rose to its highest for five months." And, that was result of solid foreign demand that drove new order growth and export sales. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, also said in the accompanying statement that "overall operating conditions of the manufacturing sector improved further as market demand strengthens, but if prices rise too quickly the profitability of companies in the middle of a supply chain may be under pressure."

Also released in Asian session, Japan consumer confidence dropped to 4.3.3 in August, down from 43.8 and missed expectation of 43.6. PMI manufacturing was revised down to 52.2 in August. Capital spending rose only 1.5% in Q2. From New Zealand, terms of tarde index rose 1.5% qoq in Q2, below expectation of 3.0% qoq.

Looking ahead, PMI data are the main focus in European session. Eurozone will release PMI manufacturing revision. UK will release PMI manufacturing. Swiss will release SVME PMI and retail sales. Later in the day, non-farm payroll from US will take center stage while ISM manufacturing will also be featured.

USD/CAD Daily Outlook

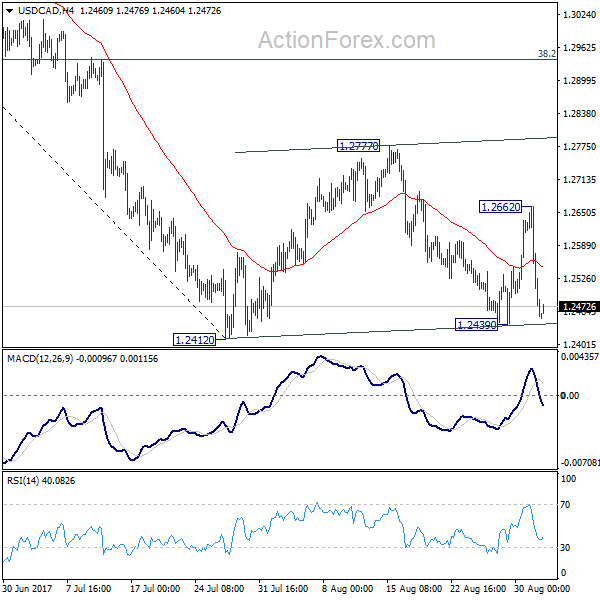

Daily Pivots: (S1) 1.2418; (P) 1.2541; (R1) 1.2605; More….

USD/CAD’s reversed and dropped sharply after hitting 1.2662. But it’s staying above 1.2412 low and intraday bias is turned neutral first. Consolidation from 1.2412 could still expect and above 1.2662 will bring another rise. But upside should be limited by 38.2% retracement of 1.3793 to 1.2412 at 1.2940 to bring fall resumption eventually. On the downside, break of 1.2412 will extend larger fall from 1.3793 and target next long term fibonacci level at 1.2048.

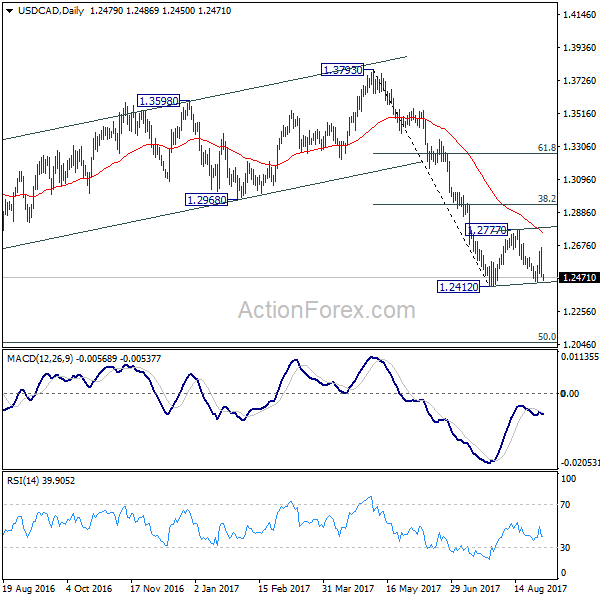

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Such corrective fall is still expected to extend to 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. Nonetheless, on the upside, sustained break of 1.2968, 38.2% retracement of 1.3793 to 1.2412 at 1.2940 will be the first sign of completion of the correction and will turn focus back to 1.3793 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q/Q Q2 | 1.50% | 3.00% | 5.10% | 3.90% |

| 23:50 | JPY | Capital Spending Q2 | 1.50% | 8.30% | 4.50% | |

| 0:30 | JPY | PMI Manufacturing Aug F | 52.2 | 52.8 | 52.8 | |

| 1:45 | CNY | Caixin PMI Manufacturing Aug | 51.6 | 51 | 51.1 | |

| 5:00 | JPY | Consumer Confidence Index Aug | 43.3 | 43.6 | 43.8 | |

| 7:15 | CHF | Retail Sales (Real) Y/Y Jul | 1.70% | 1.50% | ||

| 7:30 | CHF | SVME PMI Aug | 60.2 | 60.9 | ||

| 7:45 | EUR | Italy Manufacturing PMI Aug | 55.3 | 55.1 | ||

| 7:50 | EUR | France Manufacturing PMI Aug F | 55.8 | 55.8 | ||

| 7:55 | EUR | Germany Manufacturing PMI Aug F | 59.4 | 59.4 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Aug F | 57.4 | 57.4 | ||

| 8:30 | GBP | PMI Manufacturing Aug | 55 | 55.1 | ||

| 12:30 | USD | Change in Non-farm Payrolls Aug | 180K | 209K | ||

| 12:30 | USD | Unemployment Rate Aug | 4.30% | 4.30% | ||

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.20% | 0.30% | ||

| 13:30 | CAD | Manufacturing PMI Aug | 55.5 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 52.6 | 52.5 | ||

| 14:00 | USD | ISM Manufacturing Aug | 56.5 | 56.3 | ||

| 14:00 | USD | ISM Prices Paid Aug | 63 | 62 | ||

| 14:00 | USD | U. of Michigan Confidence Aug F | 97.3 | 97.6 | ||

| 14:00 | USD | Construction Spending M/M Jul | 0.50% | -1.30% |