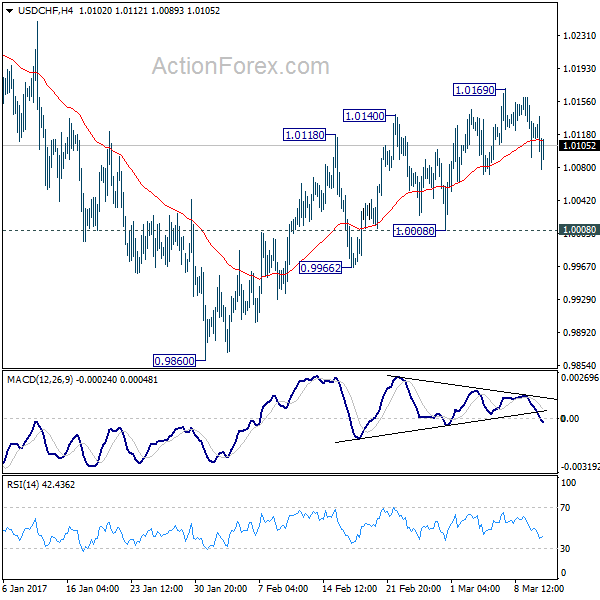

USD/CHF’s edged higher to 1.0169 last week but continued to lose upside moment. Bearish divergence is seen in 4 hour MACD. But retreat was contained well above 1.0008 support so far. The development is so far consistent with our view that while rise from 0.9860 might extend, there is no evidence to support breaking 1.0342 high.

Initial bias in USD/CHF remains neutral this week for. Further rise is expected with 1.0008 intact. Above 1.0169 will turn bias to the upside to extend rise from 0.9860. However, based on neutral medium term outlook, we’d be cautious on topping below 1.0342. On the downside, break of 1.0008, however, will indicate completion of the rebound from 0.9860. And intraday bias will be turned back to the downside for 0.9860.

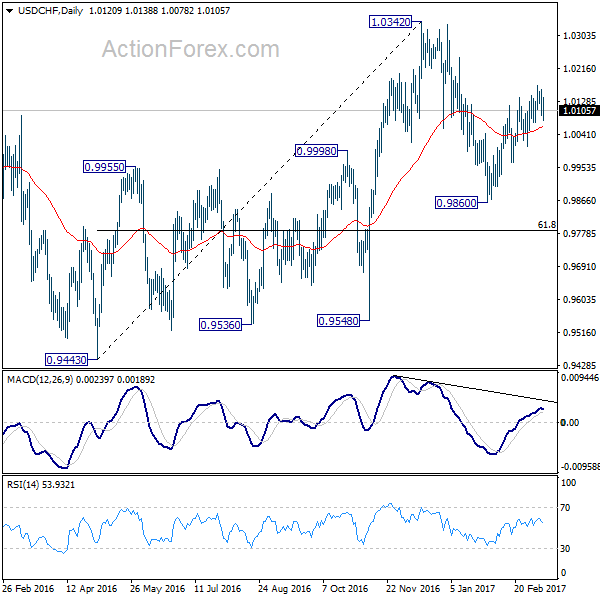

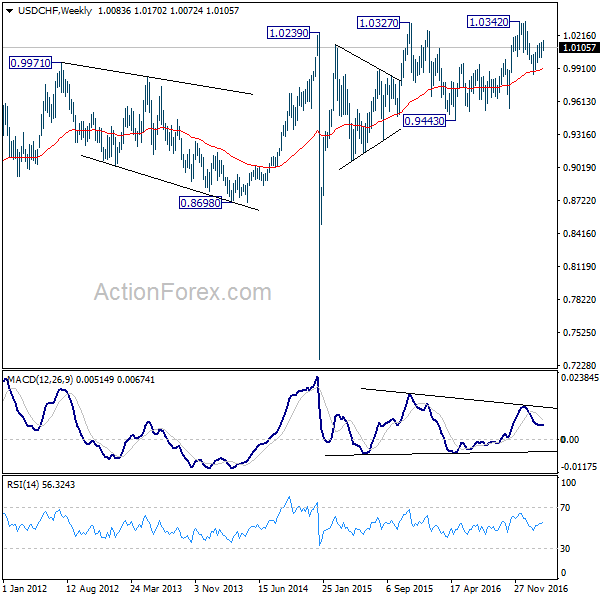

In the bigger picture, prior rejection from 1.0327 resistance argues that USD/CHF is staying in a medium term sideway pattern. In any case, decisive break of 1.0342 resistance is needed to confirm underlying strength. Otherwise, we’ll stay neutral in the pair first. In case of another fall, we’d expect strong support from 0.9443/9548 support zone.

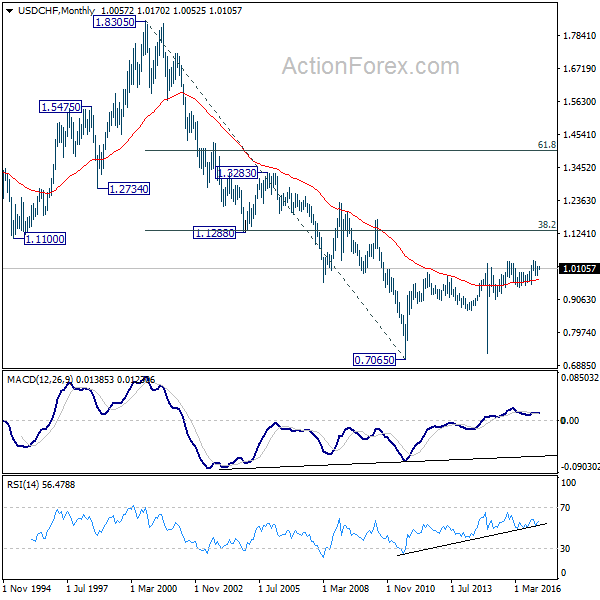

Meanwhile firm break of 1.0342 will target 38.2% retracement of 1.8305 to 0.7065 at 1.1359.