USD/CAD – 1.2546

Original strategy :

Exit short entered at 1.2595,

Position: – Short at 1.2595

Target: –

Stop: –

New strategy :

Stand aside

Position: –

Target: –

Stop:-

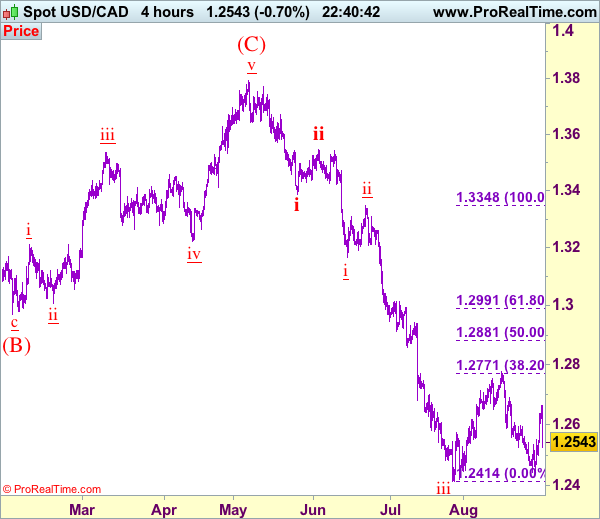

Despite staging a strong rebound from 1.2441 to 1.2663, current sharp retreat suggests further choppy trading would take place and weakness to 1.2500 cannot be ruled out, however, reckon said support at 1.2441 would hold from here and bring another rebound later. Only break of 1.2441 would revive bearishness and bring retest of 1.2414 support, having said that, the greenback needs to penetrate this wave iii trough to confirm decline has resumed in wave v to 1.2350 and then 1.2300-10.

On the upside, expect recovery to be limited to 1.2600 and said resistance at 1.2663 should remain intact, bring further choppy trading later. Above 1.2663 would bring test of resistance at 1.2691 but as outlook remains consolidative, price should falter below 1.2750, bring another decline. We are keeping our count that wave v as well as wave (C) ended at 1.3794 and impulsive wave (i ii, i ii) is now unfolding with minor wave iii ended at 1.2414, followed by wave iv correction possibly ended at 1.2778, wave v should extend towards 1.2300.

To recap, wave B from 1.3066 is unfolding as an a-b-c and is sub-divided as a: 1.2192, b: 1.2716 and wave c is a 5-waver with i: 1.1983, ii: 1.2506, extended wave iii with minor iii at 1.0206, wave iv ended at 1.0781 and wave v as well as wave iii has ended at 0.9931, hence the subsequent choppy trading is the wave iv which is unfolding as (a)-(b)-(c) with (a) leg of iv ended at 1.0854, followed by (b) leg at 1.0108 and (c) leg as well as the wave iv ended at 1.0674. The wave v is sub-divided by minor wave (i): 0.9980, (ii): 1.0374, (iii): 0.9446, (iv): 0.9913 and (v) as well as v has possibly ended at 0.9407, therefore, consolidation with upside bias is seen for major correction, indicated target at 1.3700 and 1.4000 had been met and further gain to 1.4700 would be seen later.