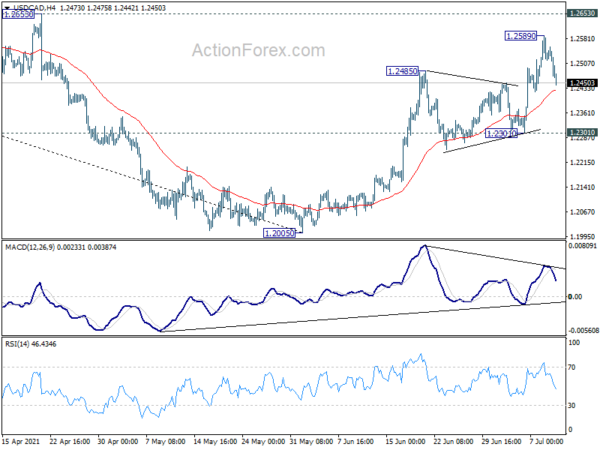

USD/CAD’s rebound from 1.2005 resumed last week and hit as high as 1.2589. But a temporary top was formed there and initial bias is turned neutral this week first. The break of medium term channel resistance is a sign of reversal. Further rise is in favor as long as 1.2301 support holds. Above 1.2589 will target 1.2653 structural resistance. However, break of 1.2301 support will dampen the bullish case and turn bias back to the downside for 1.2005 low instead.

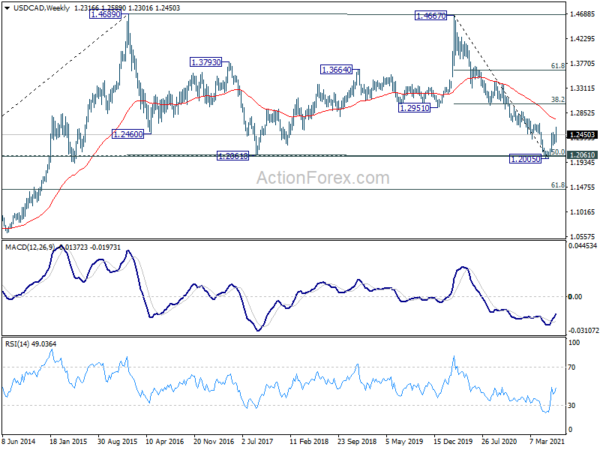

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It might have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

In the longer term picture, we’re viewing price actions from 1.4689 as a consolidation pattern. Thus, up trend from 0.9506 (2007 low) is still expected to resume at a later stage. This will remain the favored case as long as 1.2061 support holds, which is close to 50% retracement of 0.9406 to 1.4689 at 1.2048. However, sustained break of 1.2061 will be a sign of long term bearishness. Deeper fall would be seen to 61.8% retracement at 1.1424 and below.