US stocks regained bullishness overnight, with S&P 500 and NASDAQ closing at new record highs. FOMC minutes noted that tapering of asset purchases would happen “somewhat earlier” than expected, after seeing more data over the “coming months”. Meanwhile, rate hike could also come “somewhat earlier” than expected. The overall messages were largely consistent with the prior statement and projections.

Suggested readings on FOMC minutes:

- FOMC Minutes Reveals that QE Tapering to Begin Later this Year

- FOMC Minutes: More Details From The Fed, But No More Clarity

- (FED) Minutes of the Federal Open Market Committee

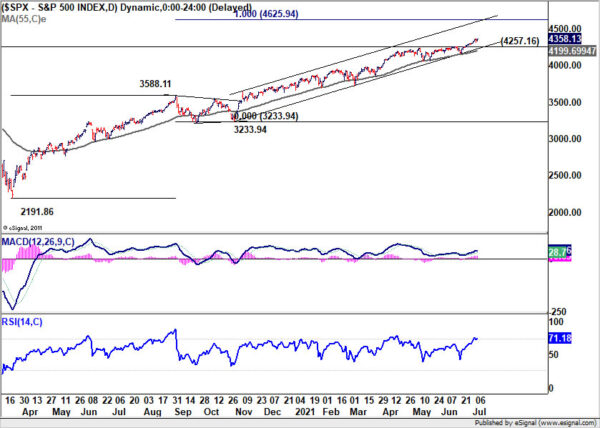

S&P 500 rose 0.34% or 14.59 pts to close at 4358.13. The current medium term up trend is still on track to 100% projection of 2191.86 to 3588.11 from 3233.94 at 4625.94. In any case, near term outlook will stays bullish as long as 4257.16 support holds, in case of retreat.