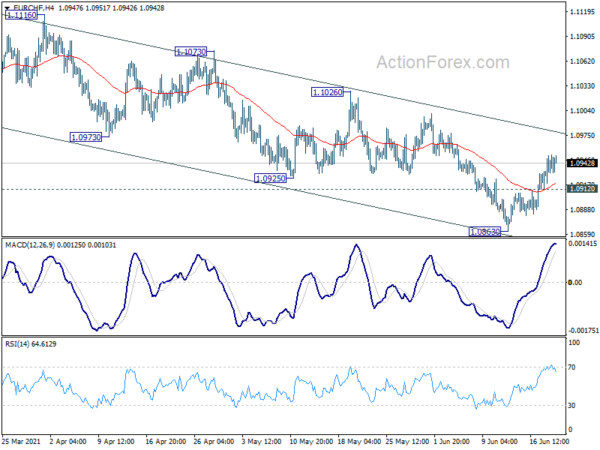

Daily Pivots: (S1) 1.0930; (P) 1.0943; (R1) 1.0964; More….

Intraday bias in EUR/CHF remains mildly on the upside at this point as rebound from 1.0863 is extending. But outlook will remain bearish as long as 1.1026 resistance holds. On the downside, below 1.0912 minor support will bring retest of 1.0863 first. Break will resume whole fall from 1.1149. however, strong break of 1.1026 will indicate near term reversal and term outlook bullish.

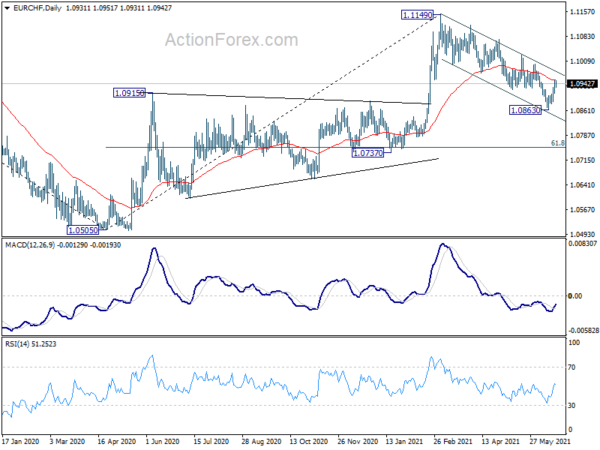

In the bigger picture, current development argues that rebound from 1.0505 might be completed at 1.1149 already. Rejection by 55 month EMA (now at 1.1077) at least keeps medium term bearishness open. Sustained break of 1.0737 support will argue that the down trend from 2004 (2018 high) is ready to resume through 1.0505 low. Sustained trading below 55 week EMA (now at 1.0879) will affirm this bearish case. Nevertheless, strong support from 55 week EMA will revive the case for resuming the rise from 1.0505 at a later stage.