Main focus for today’s ECB monetary policy decision in on the outlook of the PEPP purchases after June. The central bank significantly stepped up the pace of purchases in Q2, partly in response to the surge in sovereign yields earlier this year. The move has kept yield stable and helped improvement in the economy. Outlook also brightened with accelerated vaccination. Yet, policy makers will more likely play safe than not and maintain the current pace of purchases first, while emphasizing the flexibility of the program.

Here are some suggested previews:

- ECB Preview – Extending Current Pace of PEPP Purchases for 3 More Months

- ECB Preview: Will They Talk about Tapering?

- ECB Meeting: No Hawkish Bits Yet

- Weekly Focus – ECB to Take the Foot Slightly Off the Pedal

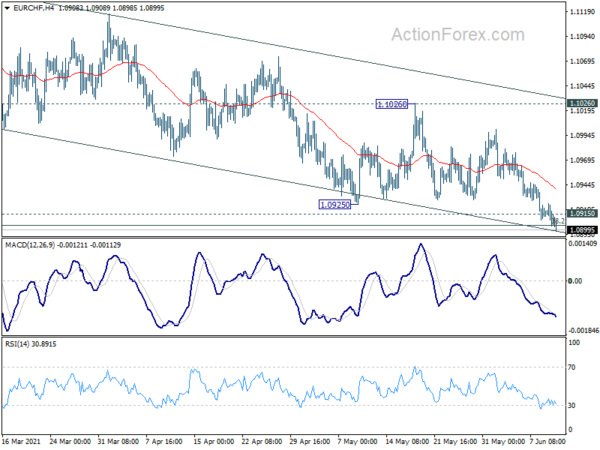

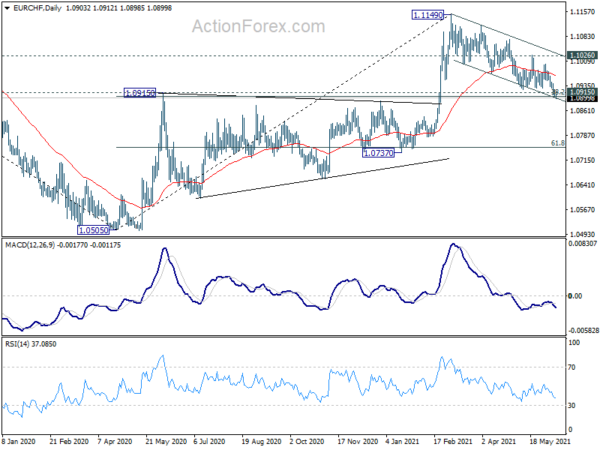

In terms of market reactions, we’d pay close attention to two European crosses, EUR/CHF and EUR/GBP. EUR/CHF dropped further ahead of the meeting and is now trading slightly below a key cluster support zone at 1.0915 (38.2% retracement 1.0505 to 1.1149 at 1.0903). Deeper selloff would also push EUR/CHF through the medium term channel support, which could bring downside acceleration. That would, at least, indicate that fall from 1.1149 is a deeper correction to whole up trend from 1.0505. Deeper fall could then be seen to 1.0737 support zone (61.8% retracement at 1.0751).

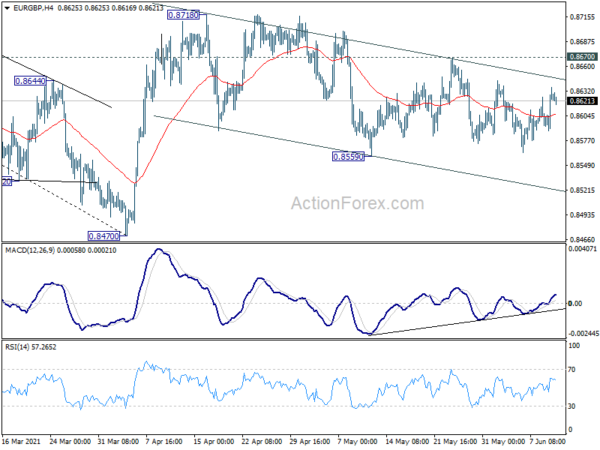

On the other hand, outlook in EUR/GBP is slightly more bullish as the price actions from 0.8718 are rather corrective. It argues that rebound fro 0.8470 is not over yet. But some committed buying is needed to push EUR/GBP through 55 day EMA firmly first. Break of 0.8670 would indeed argue that such rise is ready to resume through 0.8718. If that happens, EUR/CHF could also be given a lift back above mentioned 1.0903/15 key support zone. We’ll see which way it plays out.