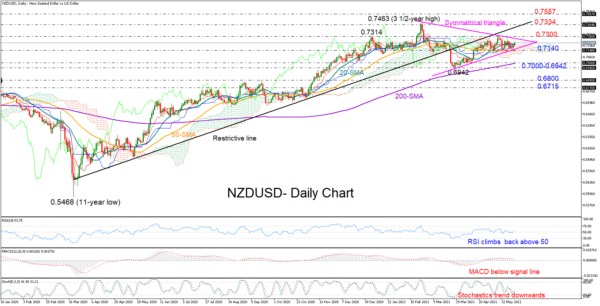

NZDUSD started the week with a slight positive momentum as the bears were unable to drive the price below the supportive 50-day simple moving average (SMA) at 0.7140 last week.

On the upside, the main target remains the 0.7300 key level, a break of which is expected to drive the price above a symmetrical triangle and hence, boost buying confidence towards February’s peak of 0.7463, where a longer-term tough restrictive line is placed as well. Beyond that, the 2017 top of 0.7557 could come next into view, while higher, resistance could run up to the 0.7740 number – a crucial barrier to downside and upside movements during the 2014 – 2015 period.

The RSI is currently backing the above bullish scenario as the indicator is trying to grow above its 50 neutral mark after refusing to post lower lows below that threshold. While a soft upward move is also noticed in the MACD and the Stochastics, the former continues to fluctuate below its red signal line and the latter keeps trending downwards, reducing the odds for a meaningful rally.

Nevertheless, sellers may not take control unless the triangle’s lower trendline and the floor around 0.7140 collapses, opening the door for the 200-day SMA and the previous support zone of 0.7000 – 0.6942. A decisive close lower from here could print a fresh trough somewhere between the 0.6800 and 0.6715 boundaries, downgrading the outlook in the short-term picture.

Summarizing, NZDUSD may attempt to breach the 0.7300 hurdle in the near term and push towards the top of a broader uptrend, though whether its efforts prove sustainable remains to be seen.

Note that the Reserve Bank of New Zealand is scheduled to announce its policy decision on Wednesday at 02:00 GMT.