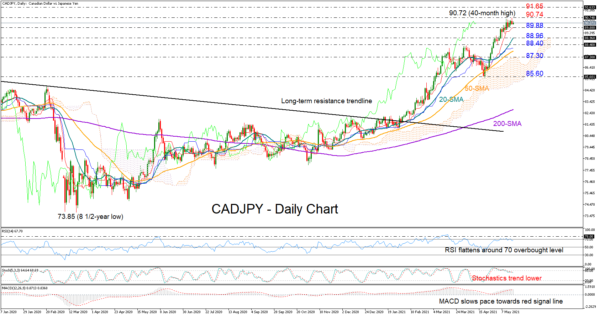

CADJPY maintains a strong upward trajectory both in the short- and medium-term timeframes, with the price ticking to a fresh 40-month high of 90.72 on Tuesday.

The positively charged simple moving averages (SMAs) are endorsing the bullish direction in the market, though the momentum indicators suggest that upside pressures are evaporating as the RSI is sidelining around its 70 overbought mark and the Stochastics are trending downwards. The MACD is also slowing pace towards its red signal line, justifying the lack of energy in the price.

The recent rally pushed the price towards the long-term resistance zone of 90.74 – 91.65, which also coincides with the 50% Fibonacci retracement level of the 2014 – 2020 sell-off. Therefore, a downside correction cannot be ruled out in the short-term. If the red Tenkan-sen line cracks, the 20-day SMA at 88.96 and the 88.40 restrictive area could immediately set a safety net. In the event of steeper declines, the surface of the Ichimoku cloud seen around 87.30 may attract special attention given its protective function since the end of December. Failure to hold above this border could see an extension towards April’s support of 85.60.

Alternatively, if buyers successfully clear the 91.65 boundary, the next stop could be within the key 93.24 – 94.30 region, which was last active during the 2013 – 2015 period. Higher, the way would open towards the 96.00 hurdle.

Summarizing, CADJPY is looking cautiously bullish in the short-term as the recent positive action seems to be losing steam around a tough resistance area. Yet, unless the price tumbles below the cloud, the upward pattern in the market may remain an influence of buying confidence.