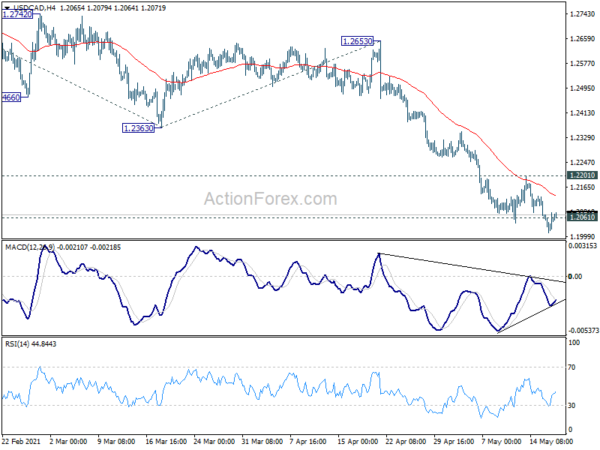

Daily Pivots: (S1) 1.2023; (P) 1.2052; (R1) 1.2091; More…

Intraday bias in USD/CAD is turned neutral first, with 4 hour MACD crossed above signal line. On the upside, break of 1.2201 resistance will indicate short term bottoming, on strong support from 1.2061 support zone. Intraday bias will be turned back to the upside for rebound. However, break of 1.2061 support will carry larger bearish implications. Next target will be 161.8% projection of 1.2880 to 1.2363 from 1.2653 at 1.1816.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). We’re look for strong support from 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048 to bring rebound. Nevertheless, sustained break of 1.2653 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound. Also, sustained break of 1.2061 will pave the way to 61.8% retracement of 0.9406 to 1.4689 at 1.1424.