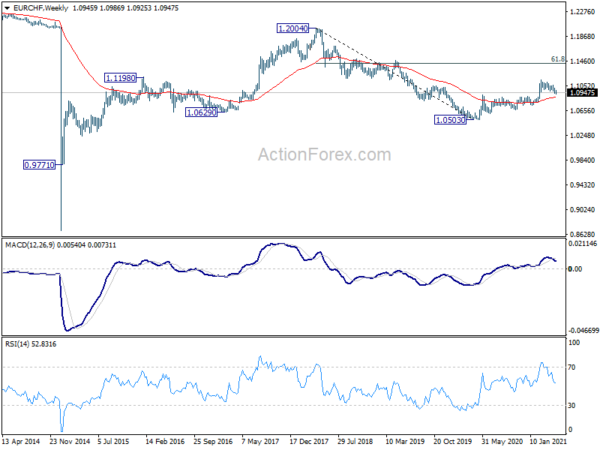

EUR/CHF edged lower to 1.0925 last week but quickly recovered. Initial bias stays neutral this week first. We continue view price actions from 1.1149 as a consolidation pattern. On the upside, break of 1.1073 resistance will argue that larger rise from 1.0503 is ready to resume through 1.1149. However, firm break of 1.0915 resistance turned support will suggest bearish reversal and turn bias to the downside.

In the bigger picture, whole down trend from 2004 (2018 high) should have completed at 1.0503. Rise from there is starting a medium term up trend. Next target is 61.8% retracement of 1.2004 to 1.0503 at 1.1431 and above. This will now remain the favored case as long as 1.0915 resistance turned support holds. However, sustained break of 1.0915 will argue that rise from 1.0503 might be completed, and bring deeper fall to 1.0737 support next.