Australian Dollar trades generally lower today, after China announced to “indefinitely” suspended all activities under the China-Australia Strategic Economic Dialogue. But the spike on Aussie was relatively shallow and short-lived. Traders are quick to remember that the tariffs by China on some Aussie products didn’t had much material impacts on the latter’s export performance. Additionally, European Commission announced earlier this week to pause all efforts to promote the China comprehensive agreement on investment. Such developments also had little impact on Euro’s exchange rate. Meanwhile, Sterling is mixed, awaiting BoE rate decision, and any hints on tapering of asset purchases.

Technically, Aussie is still bounded in near term consolidations against Dollar, Euro and Yen. Another rise through 0.7815 resistance is in favor in AUD/USD with 0.7676 minor support intact. But we’re not anticipating a break of 0.8006 high for the near term. EUR/AUD is also staying in range of 1.5250/5689, and the sideway consolidation could extend for a while. As for AUD/JPY, further rise to retest 85.43 is mildly in favor with 83.91 minor support intact. Though, current momentum doesn’t warrant a break out from there yet.

In Asia, at the time of writing, Nikkei is trading up 1.72%. Hong Kong HSI is up 0.17%. China Shanghais SSE is down -0.22%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is down -0.0048 at 0.090. Overnight, DOW rose 0.29%. S&P 500 rose 0.07%. NASDAQ dropped -0.37%. 10-year yield dropped -0.008 to 1.584.

Fed Rosengren: Premature to focus on tapering

Boston Fed President Eric Rosengren said on Wednesday that “significant slack remains in the economy”. “Substantial improvement” is needed to Fed to begin tapering. “It is quite possible that we’ll see those conditions as we get to the latter half of the year,” he said.

“But right now what we have is one really strong employment report, one quarterly strong GDP report,” Rosengren added. “And so I think it’s premature right now to focus on the tapering.” He emphasized, “the Fed has no desire to surprise markets.”

Separately, Vice Chair Richard Clarida told CNBC, “we’re still a long way from our goals, and in our new framework, we want to see actual progress and not just forecast progress.” Asked about when the Fed should start talking about tapering, he said, “we don’t think so right now.”

Fed Mester: My positive baseline outlook depends on very accommodative policy

Cleveland Fed President Loretta Mester said she expected unemployment rate to fall to 4.5% or lower this year, with GDP growth in 6-7% range. She emphasized, “my positive baseline outlook depends on appropriate monetary policy, which, in my view, will need to be very accommodative for some time to support the broadening of the recovery.”

“I wouldn’t consider the increase in inflation I expect this year to be the type of sustainable increase needed to meet the forward guidance on our policy rate,” she said. “So I expect to be deliberately patient unless there is clear evidence that inflation pressures will push inflation to exceed our desired path.”

“I need to see more improvement before I would consider the conditions of our forward guidance on asset purchases as being met,” said Mester.

New Zealand ANZ business confidence rose to 7, inflation expectations surged

Preliminary reading of New Zealand ANZ business confidence improved to 7.0 in May, up from -2.0. Own activity outlook also rose to 32.3, up from 22.2. Export intentions rose to 14.9, from 9.1. Investment intentions rose to 20.8, from 17.1. Employment intentions rose to 22.1, from 16.4. Pricing intentions rose to 57.6, from 55.8. Inflation expectations surged to 2.17, from 1.97.

ANZ said: “Any ECON 101 student or business person can tell you that strong demand and hampered supply is a sure-fire recipe for inflation. The RBNZ can ignore it only as long as inflation expectations remain well-anchored. So far so good; but it’s a lagging, not leading, indicator.”

GBP/CHF building a base, some BoE previews

BoE is widely expected to keep monetary policy unchanged today. Bank rate will be held at 0.10%. Government bond purchase target will be kept at GBP 876B, corporate debts target at GBP 20B. Focuses will be on new economic projections, as well as any hints on tapering.

GDP growth forecast for 2021 could be upgraded from February’s 5% to 6-8%. Unemployment rate could be seen as peaking at just above 6% in Q2, comparing to 7.8% as estimated in February.

BoE could hold their cards to chest on tapering, and wait for more information regarding reopening of the economy and developments. There could be some form of communications at June meeting, while tapering might begin in August. Still, the BoE would still use up the entire target of GBP 875B to purchase government bonds.

Some previews here:

- BOE Preview: Economic Forecasts to be Upgraded, while QE Tapering to Begin in August

- Bank of England: Taper Time?

- BOE Preview: Are We Nearing The End Of Story?

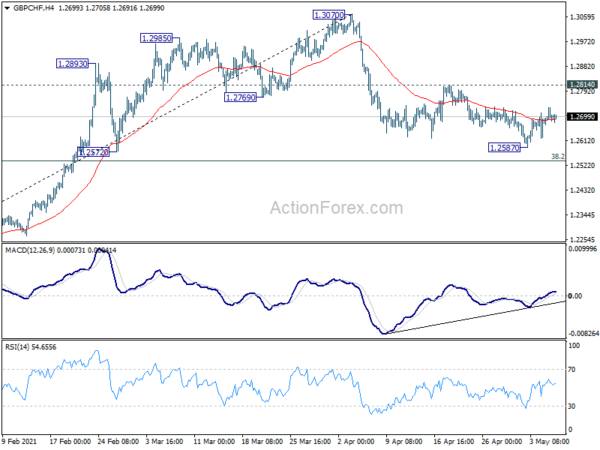

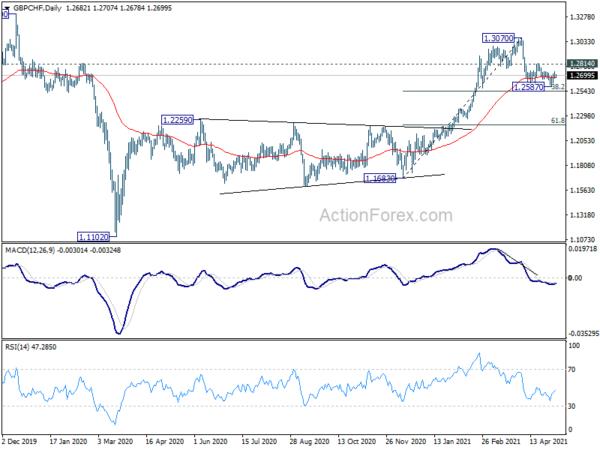

GBP/CHF’s pull back from 1.3070 has been clearly losing downside momentum in the past two weeks, as seen in 4 hour MACD. But there is no clear sign of a sustainable rebound yet. It could still take some more time to form a base.

Nevertheless, we’d continue to expect strong support from 38.2% retracement of 1.1683 to 1.3070 at 1.2540 to complete the correction. Break of 1.2814 minor resistance will turn bias to the upside for retesting 1.3070. Break there will resume larger up trend from 1.1102, for 1.3310 resistance.

Elsewhere

Germany factory orders, Eurozone retail sales, and UK PMI services will be released in European session. ECB will publish monthly economic bulletin. Later in the day, US will release jobless claims and non-farm productivity.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2239; (P) 1.2277; (R1) 1.2301; More…

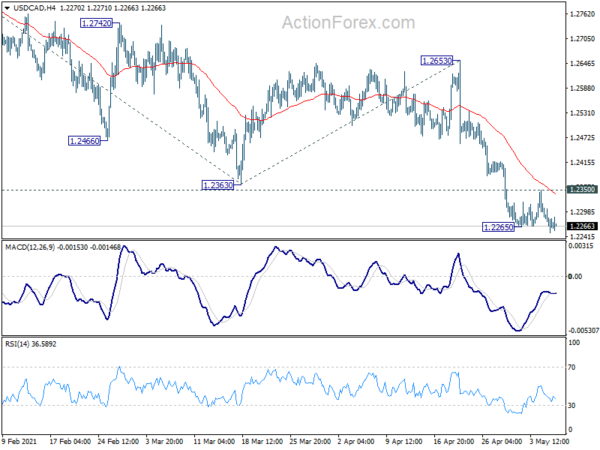

USD/CAD’s down trends resumed by breaking 1.2265 temporary low and intraday bias is back on the downside. Next target is 100% projection of 1.2880 to 1.2363 from 1.2653 at 1.2136. On the upside, however, break of 1.2350 minor resistance should now indicate short term bottoming. Intraday bias would then be turned back to the upside for rebound to 55 day EMA (now at 1.2524).

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). We’d look for strong support from there to bring rebound. Nevertheless, sustained break of 1.2653 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | 17.90% | -18.20% | -19.30% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 1:00 | NZD | ANZ Business Confidence May P | 7 | -8.4 | -2.0 | |

| 6:00 | EUR | Germany Factory Orders M/M Mar | 1.90% | 1.20% | ||

| 8:00 | EUR | ECB Economic Bulletin | ||||

| 8:30 | GBP | Services PMI Apr F | 60.1 | 60.1 | ||

| 9:00 | EUR | Eurozone Retail Sales M/M Mar | 1.40% | 3.00% | ||

| 11:00 | GBP | BoE Rate Decision | 0.10% | 0.10% | ||

| 11:00 | GBP | BoE Asset Purchase Facility | 875B | 895B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Apr | -86.20% | |||

| 12:30 | USD | Initial Jobless Claims (Apr 30) | 540K | 553K | ||

| 12:30 | USD | Nonfarm Productivity Q1 P | 3.50% | -4.20% | ||

| 12:30 | USD | Unit Labor Costs Q1 P | -0.70% | 6.00% | ||

| 14:30 | USD | Natural Gas Storage | 15B |