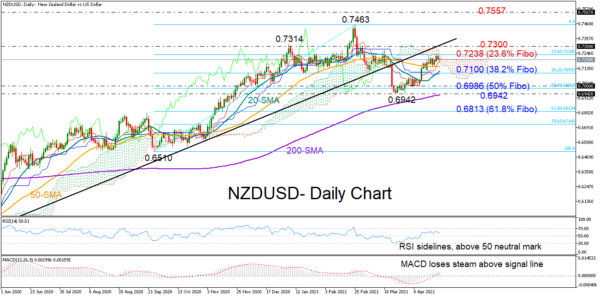

NZDUSD has been struggling to surpass the wall composed by the squeezed Ichimoku cloud and the 23.6% Fibonacci of the 0.6510 – 0.7463 up leg at 0.7238 over the past week.

The short-term bias remains tilted to the upside, though it is currently looking anemic as the RSI is ranging above its 50 neutral mark, while the MACD is rising at a slower pace within the positive area.

Slightly above the 0.7238 resistance, the broken supportive trendline seen around 0.7300 could be another crucial barrier to watch. If the bulls manage to claim that obstacle, the way would open towards the 0.7463 peak and then up to the 2017 top of 0.7557.

Alternatively, a downside reversal may initially examine the 50-day simple moving average (SMA) at 0.7145 before heading for the 38.2% Fibonacci of 0.7100. A step lower could develop aggressively towards the 50% Fibonacci of 0.6986, a break of which could immediately halt near the crucial support region of 0.6942 and the 200-day SMA. Any violation at this point may stretch the downfall from 0.7463 towards the 61.8% Fibonacci of 0.6813, downgrading the short-term outlook back to bearish.

In brief, NZDUSD is facing a weakening bullish bias as key barriers arise ahead. A clear close above 0.7300 could strengthen buying appetite.