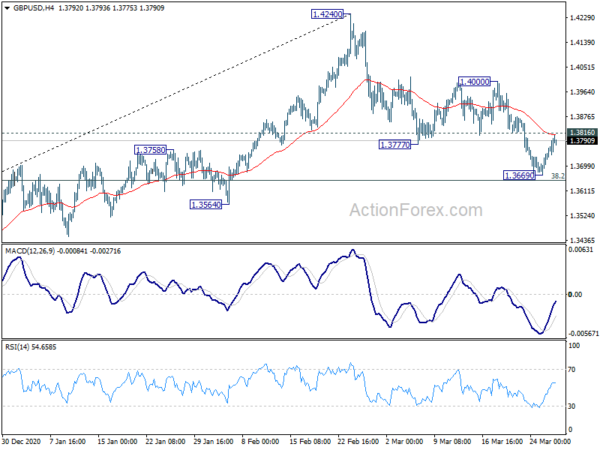

GBP/USD’s correction from 1.4240 extended to 1.3669 last week, but recovered just ahead of 38.2% retracement of 1.2675 to 1.4240 at 1.3642. Initial bias remains neutral this week first. On the upside, firm break of 1.3816 minor resistance should indicate short term bottoming. Intraday bias will be turned back to the upside for 1.4000 resistance and then 1.4240 high. However, sustained break of 1.3564 will bring deeper fall to 1.3482 key resistance turned support.

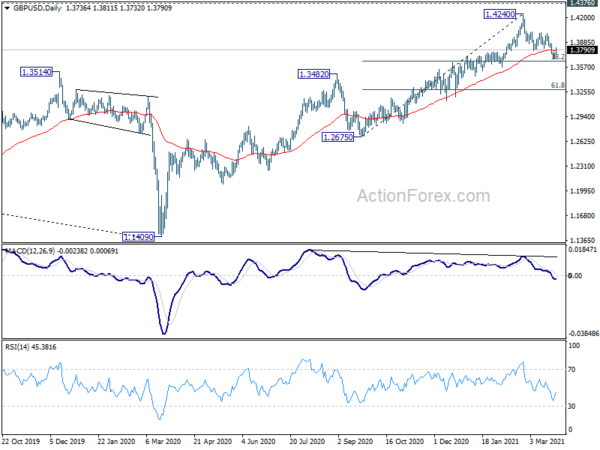

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. Decisive break there will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. On the downside, break of 1.3482 resistance turned support is needed to be first indication of completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

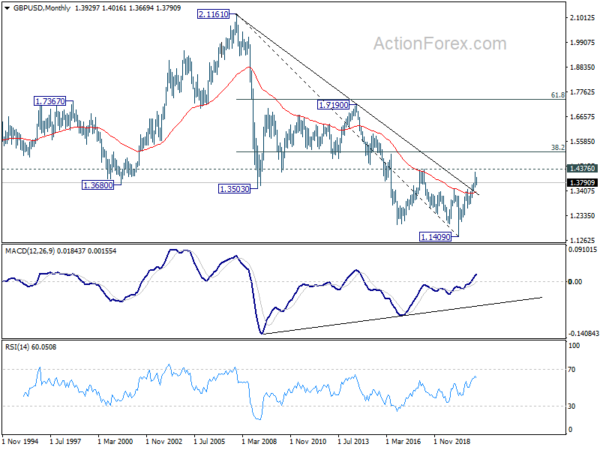

In the longer term picture, a long term bottom should be in place at 1.1409, on bullish convergence condition in monthly MACD. Rise from there would target 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Reaction from there would reveal whether rise from 1.1409 is just a correction, or developing into a long term up trend.