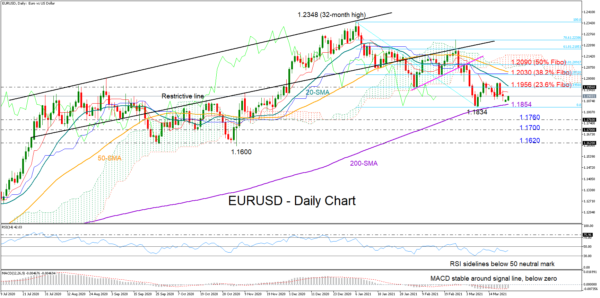

EURUSD was struggling to cross above the 1.1900 level earlier on Monday, having opened the day with a bearish gap, which pressed the price as low as 1.1868.

The technical indicators are painting a neutral-to-bearish picture for the short term as the RSI continues its sideways move below its 50 neutral mark and the MACD remains trendless within the negative area and around its red signal line.

Other discouraging signs come from the downward sloping 20- and 50-day simple moving averages (SMAs), which recently negatively intersected each other. On the other hand, the strengthening 200-day SMA slightly beneath the market action at 1.1854 could be a protector against selling pressures and an opportunity to re-challenge the tough resistance around the 20-day SMA and the 23.6% Fibonacci of the 1.2348 – 1.1834 down leg at 1.1956. If the bulls claim the latter, the focus will immediately turn to the 38.2% Fibonacci of 1.2030 and the 50-day SMA, while further up, the 50% Fibonacci of 1.2090 could be another obstacle to watch.

In the negative scenario where the price closes clearly below the 200-day SMA and its previous low of 1.1834, the downward pattern could see an extension towards the 1.1760 support region. Deeper, the 1.1700 mark may stop the sell-off from reaching the 1.1620 base.

Summarizing, EURUSD is expected to hold a neutral performance in the near-term unless it tumbles below the 200-day SMA and the 1.1835 low, strengthening the case of a down-trending market.