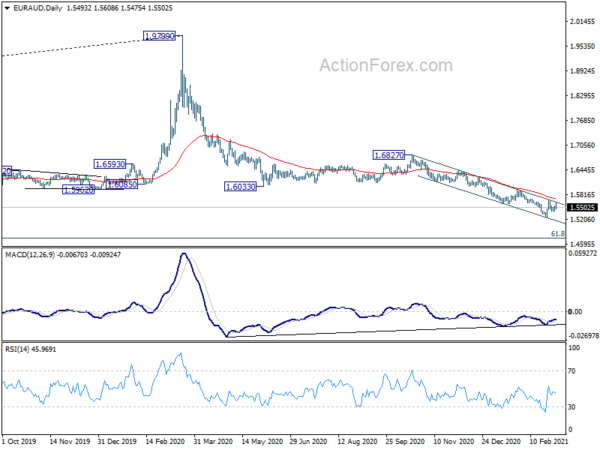

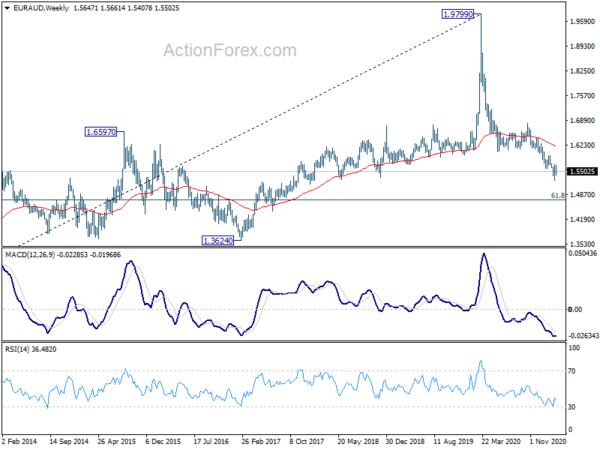

EUR/AUD stayed in range of 1.5250/5689 last week and outlook remains bearish as it’s staying inside near term falling channel. On the downside, break of 1.5250 low will resume larger down trend from 1.9799, for 1.4733 fibonacci level. On the upside, though, break of 1.5689 and sustained trading above channel resistance will indicate short term bottoming. Intraday bias will be turned back to the upside for 1.5945 resistance and above.

In the bigger picture, price actions from 1.9799 are developing into a deep correction, to long term up trend from 1.1602 (2012 low). Deeper fall would be seen to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. Medium term outlook will remain bearish as long as 1.6033 support turned resistance holds, even in case of strong rebound.

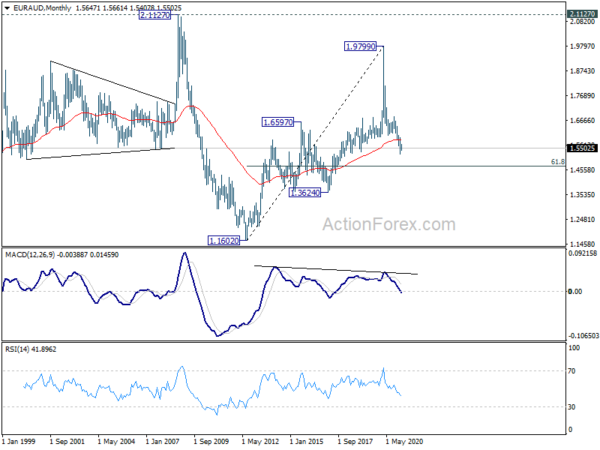

In the longer term picture rise from 1.1602 (2012 low) could have already completed with three waves up to 1.9799. The development suggests that long term range trading is extending with another medium term down leg. Sustained trading below 55 month EMA (now at 1.5838) now further affirms this case could bring deeper decline to 1.1602/3624 support zone.