The forex markets are lacking clear direction so far this week. It feels there is a lack of interest among traders ahead of Jackson Hole symposium. Euro attempted to resume recent rally against Dollar. While EUR/USD takes out a near term channel resistance, it’s staying below 1.1846 resistance. Thus, the consolidation from 1.1908 is likely still in progress. GBP/USD and USD/JPY are also staying in very tight range. Canadian dollar strengthens with very weak momentum but USD/CAD is still in progress for deeper decline. The economic calendar is relatively light today but Canadian retail sales could trigger firmer momentum in USD/CAD.

Trump revealed Afghanistan strategy, Mnuchin urge to raise debt ceiling

US President Donald Trump revealed his Afghanistan strategy and said "a core pillar of our new strategy is a shift from a time-based approach to one based on conditions." But there are criticisms that Trump’s new strategy was essentially the same as his predecessors, which failed to get the US our of that war. At the same time Treasury Secretary Mnuchin indicated that the Congress has to lift the ceiling by the end of September in a "clean" debt-ceiling increase. This was echoed by Senate Majority Leader Mitch McConnell who noted that there is a "zero chance" the US government fails to raise the ceiling. Mnuchin has been urging to lift the debt ceiling before leaving Washington for the August recess. Indeed, the Treasury has been using "extraordinary measures" since this spring to avoid breaching the debt ceiling but the trick cannot be used indefinitely due to weaker tax collection.

Japan businesses not keen on additional BoJ easing

According to a survey of 548 firms conducted for Reuters Nikkei Research, businesses in Japan were not too optimistic that BoJ could hit the 2% inflation target. Yet, they are not keen on having additional easing from the central bank. The results showed that 31% of respondents believed it’s "impossible" for BoJ to achieve the inflation target. 37% believed that BoJ could hit it after three years. 46% said that BoJ’s future policy direction should be standing pat. 40% said BoJ should seek exit from monetary easing. And only 14% believed that BoJ should adopt further monetary easing. Inflation expectation was also quite clear with 75% said they don’t play to raise prices of their main goods and services.

ECB to hit 33% bond purchase ceiling soon

A report by Financial Times revealed that the ECB is about to break its self-imposed limit of owning 33% of a country’s government debt, leading the central bank to taper no matter how well (or bad) inflation goes. It is projected that the limits for German, Portuguese and Irish debts could be breached as early as in February. At the same time, it’s believed to be unlikely for ECB to raise the ceiling considering continuous legal challenges from Germany. President Mario Draghi’s speech at the Jackson Hole symposium this Thursday is closely awaited. He would likely discuss about the Eurozone’s economic outlook and hinted about the central bank’s policy stance.

On the data front

Swiss trade surplus widened to CHF 3.51b in July. German ZEW economic sentiment is the main feature in European session. UK will release public sector net borrowing. Canada retail sales will be a major focus in US session. US will release house price index.

EUR/USD Daily Outlook

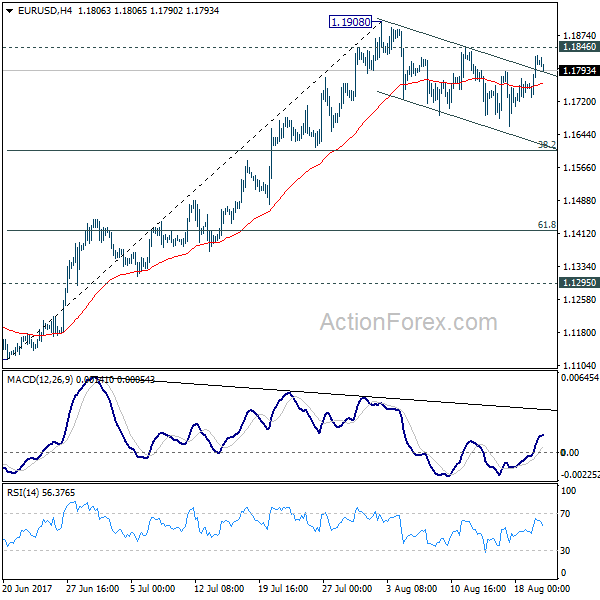

Daily Pivots: (S1) 1.1753; (P) 1.1790 (R1) 1.1851; More…

While EUR/USD recovered, it’s limited below 1.1846 minor resistance so far. Intraday bias remains neutral as consolidation from 1.1908 might extend. In case of another fall, downside should be contained by 38.2% retracement of 1.1119 to 1.1908 at 1.1606 to bring up trend resumption. Break f 1.1846 minor resistance will argue that larger rise from 1.0339 is resuming for 1.2042 long term support turned resistance next.

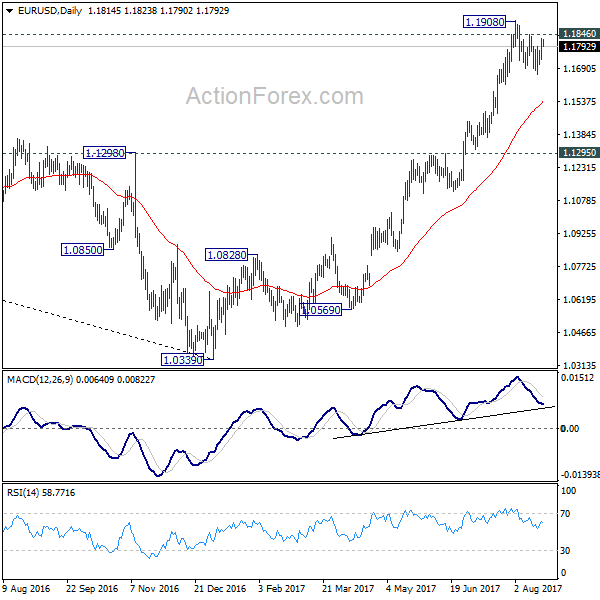

In the bigger picture, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Sustained trading above 55 month EMA (now at 1.1768) will pave the way to key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. While rise from 1.0339 is strong, there is no confirmation that it’s developing into a long term up trend yet. Hence, we’ll be cautious on strong resistance from 1.2516 to limit upside. But for now, medium term outlook will remain bullish as long as 1.1295 support holds, in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | CHF | Trade Balance (CHF) Jul | 2.88B | 2.81B | ||

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Jul | 0.3B | 6.3B | ||

| 09:00 | EUR | German ZEW (Economic Sentiment) Aug | 15 | 17.5 | ||

| 09:00 | EUR | German ZEW (Current Situation) Aug | 85.5 | 86.4 | ||

| 09:00 | EUR | Eurozone ZEW (Economic Sentiment) Aug | 34.2 | 35.6 | ||

| 10:00 | GBP | CBI Trends Total Orders Aug | 10 | 10 | ||

| 12:30 | CAD | Retail Sales M/M Jun | 0.30% | 0.60% | ||

| 12:30 | CAD | Retail Sales Less Autos M/M Jun | 0.30% | -0.10% | ||

| 13:00 | USD | House Price Index M/M Jun | 0.50% | 0.40% |