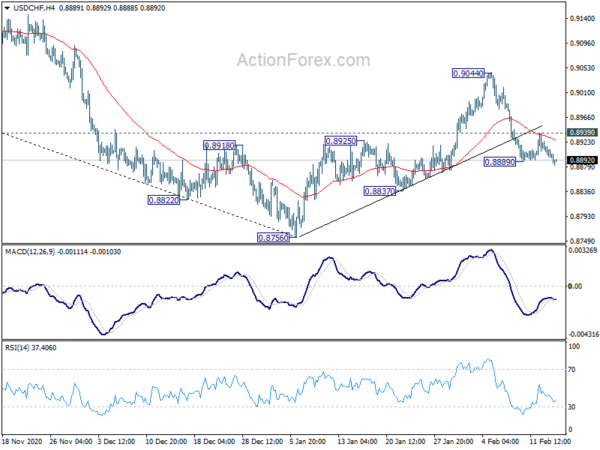

Daily Pivots: (S1) 0.8893; (P) 0.8909; (R1) 0.8920; More….

USD/CHF’s break of 0.8889 suggest resumption of fall from 0.9044. As noted before, corrective rise from 0.8756 should have completed with three waves up to 0.9044. Intraday bias is now on the downside for 0.8847 and then 0.9756 low. On the upside, though, break of 0.8939 minor resistance will turn bias back to the upside, and could extend the corrective rise from 0.8756 through 0.9044.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9295 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.