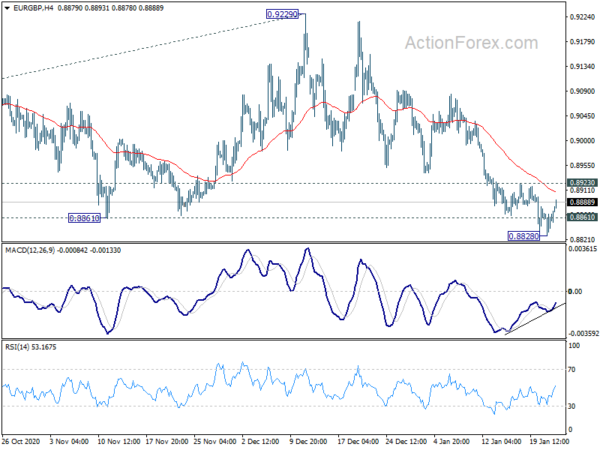

Daily Pivots: (S1) 0.8836; (P) 0.8854; (R1) 0.8877; More…

EUR/GBP recovered after failing to sustain above 0.8861 support and intraday bias is turned neutral first. Another fall is in favor as long as 0.8923 resistance holds. Sustained trading below 0.8861 support will confirm that corrective rebound form 0.8670 has completed. Fall from 0.9929 is seen as the third leg of the pattern from 0.9499. Deeper decline would be seen back to 0.8670 support. On the upside, though, break of 0.8923 will indicate short term bottoming and turn bias back to the upside for stronger rebound.

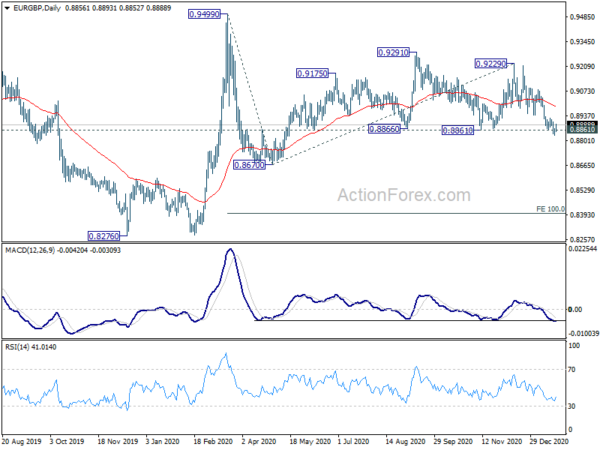

In the bigger picture, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. Decisive break of 0.9499 will target 0.9799 (2008 high).