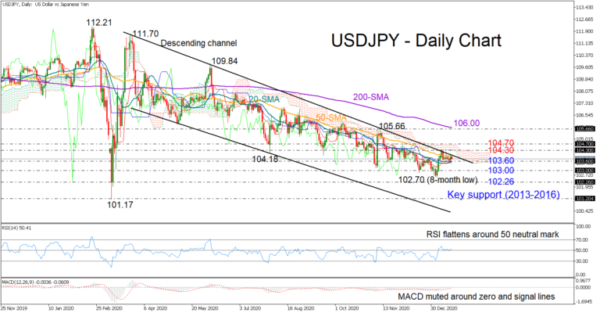

USDJPY is trapped between its 20- and 50-day simple moving averages (SMAs) and beneath the surface of the crucial 10-month old descending channel as the 104.00 level keeps cancelling bullish actions.

The RSI and the MACD remain flat around their neutral levels, whereas the bullish cross between the red Tenkan-sen and Blue Kijun-sen lines is currently providing hope that the next move in the price could be positive. The latter, however, awaits a confirmation above the 104.00 number and the channel’s topline, while a rally beyond the 104.30 – 104.70 restrictive area and the Ichimoku cloud is expected to stretch towards the 105.66 resistance.

On the flip side, a close below the 20-day SMA and the 103.60 support zone could spark selling orders towards the 103.00 barrier. Running lower, the price may seek shelter around 102.26, where the market staged an impressive rally back in March. Should the bears break through that floor too, the door would open for the 101.17 trough from March 9.

In brief, USDJPY retains a neutral profile in the short-term picture. A sustainable upside correction above the channel and the 104.00 hurdle or a step below the 103.60 base is needed to switch the bias accordingly.