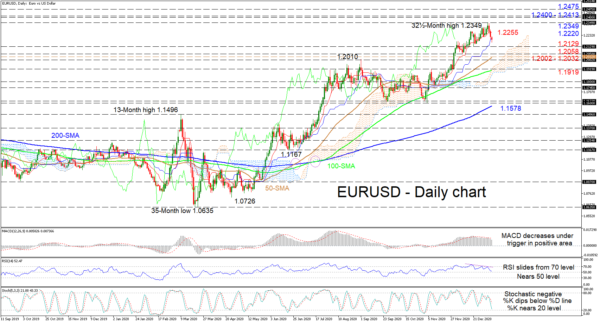

EURUSD is sustaining a negative tone today after plotting two bearish daily candles off of a 32½-month peak of 1.2349. In spite of the convincing pullback, which is proposing a deeper retracement, the predominant simple moving averages (SMAs) are continuing to protect the positive picture.

The Ichimoku lines with the clear dip in the red Tenkan-sen line are suggesting a slowing pace in positive price action, while the short-term indicators are portraying a surge in negative momentum. The MACD, some distance above zero, is plunging below its red trigger line, while the decreasing RSI is approaching its 50 threshold. Furthermore, the price’s current negative tendency appears to be endorsed by the strong bearish demeanour of the stochastic oscillator.

If the pair continues to deteriorate below the blue Kijun-sen line, early support may commence from the respective 1.2129 and 1.2058 troughs before tackling the limiting section of 1.2002-1.2032. Another negative blow conquering the vicinity of the 50-day SMA could send the price diving for the 1.1919 level, reinforced by the 100-day SMA.

On the flipside, if buyers manage to steer the price back up, initial upside hindrance could occur at the red Tenkan-sen line at 1.2255, before the price revisits the multi-year peak of 1.2349. Should buyers manage to overcome the fresh top, next resistance may develop in the region of 1.2400-1.2413, relating to highs in April of 2018. Triumphing above this too, the bulls may then target the 1.2475 peak from back in March 2018.

Summarizing, EURUSD retains its short-to-medium-term bullish demeanour above the Ichimoku cloud and the SMAs.