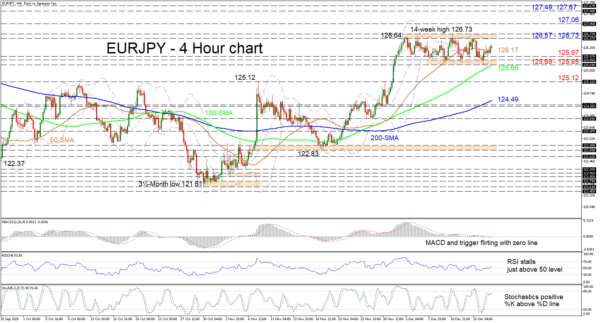

EURJPY nudged back above the 50-period simple moving average (SMA), improving slightly within the sideways move. The flattening 50-period SMA is reflecting the pause in the ascent while the rising 100- and 200-period SMAs are defending the positive structure.

The short-term oscillators reflect lethargic momentum. The MACD and its red trigger are sluggish in the vicinity of its zero line, while the RSI is trying to maintain its push above the 50 threshold. The stochastic oscillator beneath the 80 level is improving marginally, with the %K line bumping above its %D line.

Gaining extra ground in the sideways market, buyers may encounter initial heavy resistance from the section of 126.57-126.73, which also contains the upper Bollinger band. Conquering this area of highs, which includes the 14-week top of 126.73, the bulls may next pilot the pair towards the 127.06 key peak achieved on September 1. Steering higher from here, the price may propel towards the 127.49 critical high from March 1 ahead of the 127.67 barrier from December 2018.

On the other hand, if sellers drive the price below the 50-period SMA coupled with the mid-Bollinger band around 126.17, early downside limitations may occur at the 125.97 nearby low. Another step down could then face immediate support from the 125.69-125.85 foundation of the range, which also encompasses the lower Bollinger band and is reinforced by the 100-period SMA beneath at 125.65. Failing to halt the decline, the price may then aim for the critical 125.12 border.

Summarizing, EURJPY maintains a neutral-to-bullish tone above the SMAs and the 125.69-125.85 boundary. A break either below the 100-period SMA at 125.65 or above 126.73 may determine the next clear price direction.