Dollar trade with a generally soft tone today, with strong risk-on markets in the background. But overall, most major pairs and crosses are bounded inside last week’s range. The economic calendar is extremely busy for the rest for the week. But there are still a couple of things to resolve, or the data would only trigger volatility. Brexit trade agreement and US stimulus negotiations need to be cleared before markets take a firm near term direction.

Technically, USD/JPY’s break of 103.51 temporary low is the first sign of return of Dollar selloff. USD/CAD breached 1.2706 temporary low, but quickly recovered, suggesting some hesitation. Focus will now be on 0.8851 temporary low in USD/CHF, 1.2177 temporary top in EUR/USD, and 0.7578 temporary top in AUD/USD.

In Asia, Nikkei closed up 0.26%. Hong Kong HSI is up 0.83%. China Shanghai SSE is down -0.05%. Singapore Strait Times is up 0.50%. Japan 10-year JGB yield is up 0.0084 at 0.012. Overnight, DOW rose 1.13%. S&P 500 rose 1.29%. NASDAQ rose 1.25%. 10-year yield rose 0.031 to 0.923.

Japan exports struggled in record losing streak

Japan’s exports dropped -4.2% yoy to JPY 6.11T. Imports dropped -11.1% yoy to JPY 5.75T. Trade surplus came in at JPY 367B. In seasonally adjusted terms, Trade surplus widened to JPY 0.57T, slightly above expectation of JPY 0.55T.

The data marked the 24th straight month of year-over year decline in exports, longest streak on record since 1979. By destination, exports to the US contracted for the first time in three months, by -2.5% yoy. Exports to China rose 3.8% yoy, slowest pace in five months. Exports to Asia also dropped for the first time in two months, by -4.3% yoy. Exports to EU dropped -2.6% yoy.

Japan PMI Manufacturing rose to 49.5, still struggling but turning optimistic

Japan Jibun Bank PMI Manufacturing rose to 49.5 in December, up from 48.8. PMI Services dropped to 47.2, down from 47.8. PMI Composite dropped to 48.0, down from 48.1.

Usamah Bhatti, Economist at IHS Markit, said: “Despite the short-term disruption caused by a resurgence in coronavirus disease 2019 (COVID-19) cases, Japanese private sector businesses were optimistic that business conditions would improve in the year-ahead. Positive sentiment stemmed from the expectation that there would be an end to the pandemic which would fuel both domestic and international demand. Nevertheless, uncertainty surrounding the timing and pace of the economic recovery resulted in a softening of expectations.”

Australia PMI composite rose to 57, improvements in demand, employment and optimism

Australia CBA PMI Manufacturing rose to 56.0 in December, up from 55.8, hitting a 36-month high. PMI Services rose to 57.4, up from 55.1, a 7-month high. PMI Composite rose to 57.0, up from 54.9, a 5-month high.

Pollyanna De Lima, Economics Associate Director at IHS Markit, said: “Not only was the Australian economic recovery sustained in December, but growth also gathered momentum as the loosening of COVID-19 restrictions underpinned further improvements in demand for goods and services…. Both goods producers and service providers continued to hire extra staff, the former to the greatest extent in close to three years… Private sector companies were at their most optimistic in over two years…One area that failed to improve was exports… The latest fall in international sales was the eleventh in successive months.”

Australia leading index rose to 4.38, strongest growth rate in history

Australia Westpac-Melbourne Institute Leading Index rose from 3.77% to 4.38% in November. That’s the strongest growth rate in the sixty year history of the measure. Though, Westpac said “the gains still largely reflect the severity of the preceding contraction”. In level terms, the index has now “recouped 80%” of that fall.

Westpac expects RBA to introduce a second AUD 100B QE program in February meeting. That would be followed by two smaller program of AUD 50B each in the year to October 2022.

BoC Macklem: Vaccines put more certain timeline on global demand resurgence

In a speech, BoC Governor Tiff Macklem said the economic recovery from the pandemic is “at a very difficult stage”. For the nears term, rising coronavirus infections will “dampen growth and could even deepen our economic hole” and uncertainty is “elevated”. The recovery is going to be “long and choppy”.

Nevertheless, he noted that “trade has bounced back faster than many economists had predicted” and are expected to be strong in 2021. News of vaccines also “puts a more certain timeline on the resurgence of global demand”. “As a country, we need to leverage the broad trade access we have and work with like-minded countries to foster a renewed spirit of open, rules-based trade that works for the 21st century.”

Fed to stand pat and update forward guidance

Fed should leave all the monetary policy measures unchanged today: Fed funds rate should stay unchanged at 0-0.25% and asset purchases at USD120B per month. The focus of the meeting will be on the adjustment of the forward guidance about the asset purchase program. It will be a qualitative, outcome-based guidance as “most” members favored.

Additionally, the statement will be accompanied by the updated economic projections and median dot plots about the policy rate outlook. For the former, thanks to the vaccine news, the Fed might upgrade GDP growth and inflation forecasts for 2021. We expect the majority of members would project no rate hike until end-2023. Yet, it is possible that more members would anticipate an increase before that, when compared with the last projections.

Some previews here:

- FOMC Preview – Fed to Update Forward Guidance on QE

- Fed Likely to Skip QE Boost, May Adjust Composition and Forward Guidance

- FOMC Meeting Preview: Threading A Needle

Looking ahead

The economic calendar is very busy today. UK CPI, PPI and PMIs will be featured, also Eurozone PMIs and trade balance. Later in the day, Canada will release CPI and wholesale sales. US will release retail sales, PMIs, business inventories and NAHB housing index. Fed will also publish monetary policy decisions.

EUR/USD Daily Outlook

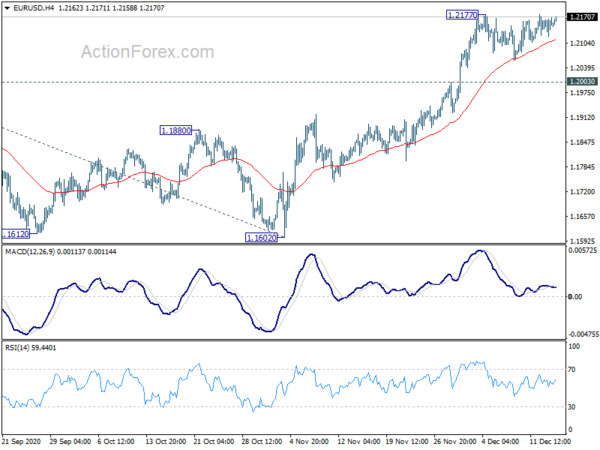

Daily Pivots: (S1) 1.2128; (P) 1.2149; (R1) 1.2175; More…..

EUR/USD is still staying in consolidation from 1.2177 and intraday bias remains neutral. In case of another retreat, downside should be be contained by 1.2003 support to bring another rise. On the upside, firm break of 1.2177 resume whole rise from 1.0635, and target 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q3 | -3.52B | -3.65B | 1.83B | 1.91B |

| 22:00 | AUD | CBA Manufacturing PMI Dec P | 56 | 55.8 | ||

| 22:00 | AUD | CBA Services PMI Dec P | 57.4 | 55.1 | ||

| 23:30 | AUD | Westpac Leading Index M/M Nov | 0.50% | 0.10% | 0.30% | |

| 23:50 | JPY | Trade Balance (JPY) Nov | 0.57T | 0.55T | 0.31T | 0.36T |

| 0:30 | JPY | Manufacturing PMI Dec P | 49.7 | 48.9 | 49 | |

| 7:00 | GBP | CPI M/M Nov | -0.10% | 0.00% | ||

| 7:00 | GBP | CPI Y/Y Nov | 0.30% | 0.60% | 0.70% | |

| 7:00 | GBP | Core CPI Y/Y Nov | 1.10% | 1.40% | 1.50% | |

| 7:00 | GBP | RPI M/M Nov | -0.30% | 0.20% | 0.00% | |

| 7:00 | GBP | RPI Y/Y Nov | 0.90% | 1.30% | 1.30% | |

| 7:00 | GBP | PPI Input M/M Nov | 0.20% | 0.20% | ||

| 7:00 | GBP | PPI Input Y/Y Nov | -0.50% | -1.30% | ||

| 7:00 | GBP | PPI Output M/M Nov | 0.20% | 0.00% | ||

| 7:00 | GBP | PPI Output Y/Y Nov | -0.80% | -1.40% | ||

| 7:00 | GBP | PPI Core Output M/M Nov | 0.00% | 0.10% | 0.20% | |

| 7:00 | GBP | PPI Core Output Y/Y Nov | 0.90% | 0.40% | 0.50% | |

| 8:15 | EUR | France Manufacturing PMI Dec P | 49.6 | 49.6 | ||

| 8:15 | EUR | France Services PMI Dec P | 39.3 | 38.8 | ||

| 8:30 | EUR | Germany Manufacturing PMI Dec P | 56.5 | 57.8 | ||

| 8:30 | EUR | Germany Services PMI Dec P | 44 | 46 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Dec P | 53 | 53.8 | ||

| 9:00 | EUR | Eurozone Services PMI Dec P | 40.9 | 41.7 | ||

| 9:30 | GBP | DCLG House Price Index Y/Y Oct | 5.10% | 4.70% | ||

| 9:30 | GBP | Manufacturing PMI Dec P | 55.9 | 55.6 | ||

| 9:30 | GBP | Services PMI Dec P | 50.5 | 47.6 | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | 24.0B | |||

| 12:30 | CAD | CPI M/M Nov | 0.40% | |||

| 12:30 | CAD | CPI Y/Y Nov | 0.70% | |||

| 12:30 | CAD | CPI Common Y/Y Nov | 1.60% | |||

| 12:30 | CAD | CPI Median Y/Y Nov | 1.90% | |||

| 12:30 | CAD | CPI Trimmed Y/Y Nov | 1.80% | |||

| 13:30 | CAD | Foreign Securities Purchases (CAD) Oct | 4.46B | |||

| 13:30 | CAD | Wholesale Sales M/M Oct | 0.90% | |||

| 13:30 | USD | Retail Sales M/M Nov | -0.20% | 0.30% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Nov | 0.20% | 0.20% | ||

| 14:45 | USD | Manufacturing PMI Dec P | 56 | 56.7 | ||

| 14:45 | USD | Services PMI Dec P | 55.9 | 58.4 | ||

| 15:00 | USD | Business Inventories Oct | 0.40% | 0.70% | ||

| 15:00 | USD | NAHB Housing Market Index Dec | 88 | 90 | ||

| 15:30 | USD | Crude Oil Inventories | 15.2M | |||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |