Cable bounced to 1.2900 zone after better than expected UK jobs data. Jobless claims fell by 4.2K in July, beating forecast for increase in claims by 3.7K while Unemployment rate fell to 4.4% in June from 4.5% forecast / previous month.

The most significant release was average earnings, with headline earnings coming at 2.1% in June vs 1.8% forecast, while ex-bonus earnings rose to 2.1% from 2.0% previous month/ forecast.

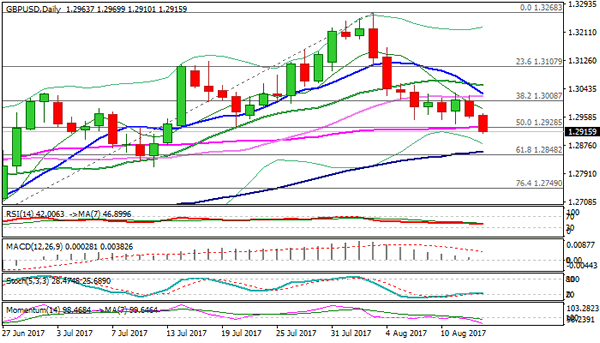

Strong jobs sector numbers are bullish signal, but pound remains under pressure and is in downtrend since the beginning of August. Long bearish candle that was left on Tuesday continues to weigh on near-term action, seeing limited upside action before bears resume for renewed attack at daily cloud (spanned between 1.2869 and 1.2818) which contained downside attempts for now.

Broken 55SMA marks solid barrier at 1.2930, followed by Tuesday’s high at 1.2970 and key barrier at 1.3000 (psychological resistance, reinforced by falling daily Tenkan-sen) which is expected to cap extended upticks.

Res: 1.2902, 1.2930, 1.2970, 1.3000

Sup: 1.2840, 1.2811, 1.2749, 1.2715