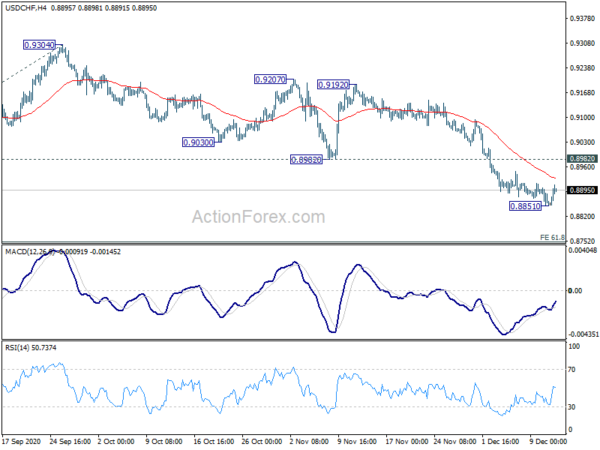

USD/CHF’s down trend continued last week and reached as low as 0.8851. As a temporary low was formed, initial bias is neutral this week for some consolidations. upside of recovery should be limited by 0.8982 support turned resistance to bring fall resumption. On the downside, break of 0.8851 will target 61.8% projection of 0.9901 to 0.8998 from 0.9304 at 0.8746 next.

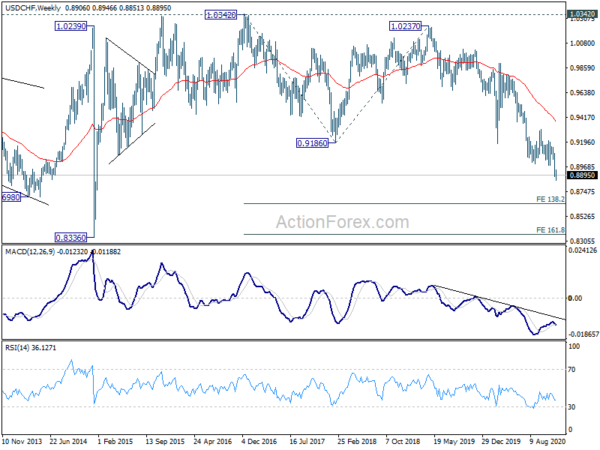

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9304 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

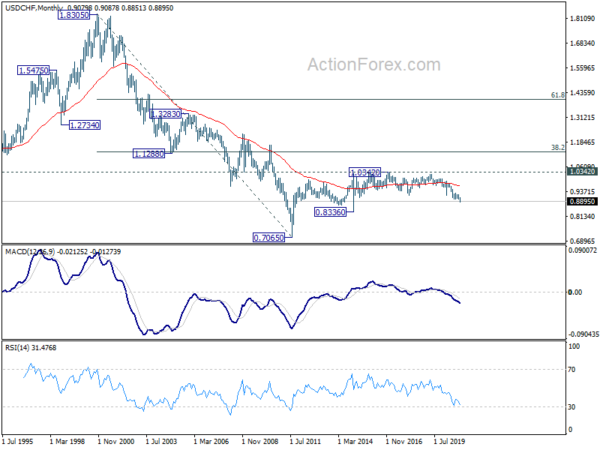

In the long term picture, price actions from 0.7065 (2011 low) are currently seen as developing into a long term corrective pattern, at least until a firm break of 1.0342 resistance.