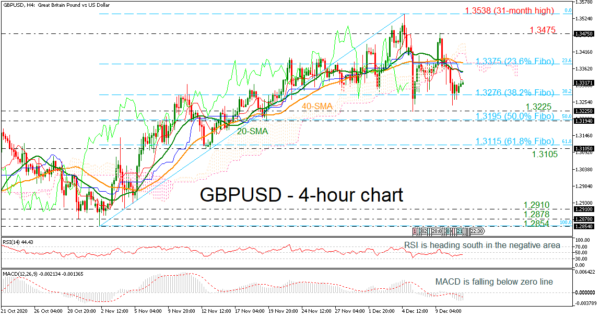

Following an aggressive sell-off, GBPUSD found support at the 38.2% Fibonacci retracement level of the up leg from 1.2854 to 1.3538 at 1.3276and is currently posting some gains over the latest 4-hour sessions

The price plummeted beneath the 20- and 40-period simple moving averages, while the momentum indicators are continuing to move in the negative territory. However, the RSI is trying to recover, while the MACD is flattening.

More advances could send the price towards the 20-period simple moving average (SMA) at 1.3354 before touching the 23.6% Fibonacci of 1.3375, which overlaps with the 40-period SMA. Even higher, the next significant resistance could come from the 1.3475 obstacle ahead of the 31-month peak of 1.3538.

A drop below the 38.2% Fibonacci of 1.3276 could open the way for the 1.3225 support and the 50.0% Fibonacci at 1.3195. More losses could drive the market until the 61.8% Fibonacci of 1.3115 before meeting the 1.3105 barrier.

To sum up, GBPUSD has been in a upside correction in the very short-term, though, in the broader outlook the bias is also bullish since October 30.