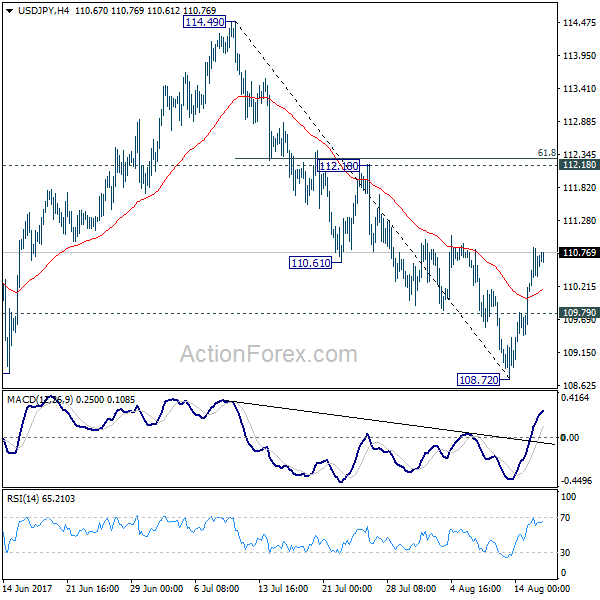

Daily Pivots: (S1) 109.90; (P) 110.37; (R1) 111.14; More…

Intraday bias in USD/JPY remains mildly on the upside for the moment. Current development argues that fall from 114.49 could have completed at 108.72. Further rise would be seen back to 112.18 resistance first. Break there will target 114.49 key near term resistance again. On the downside, break of 108.79 minor support will turn focus back to 108.72 instead.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, downside should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.