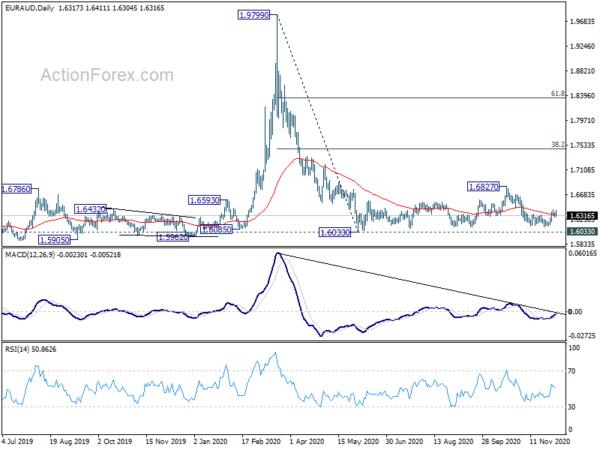

EUR/AUD rebounded to as high as 1.6420 last week but retreated. Initial bias remains neutral this week first. Current development suggest short term bottoming at 1.6122. Consolidation pattern from 1.6033 could have started another rising leg. Break of 1.6420 will turn bias to the upside for 1.6827 resistance. Nevertheless, on the downside, break of 1.6122 will bring retest of 1.6033 low.

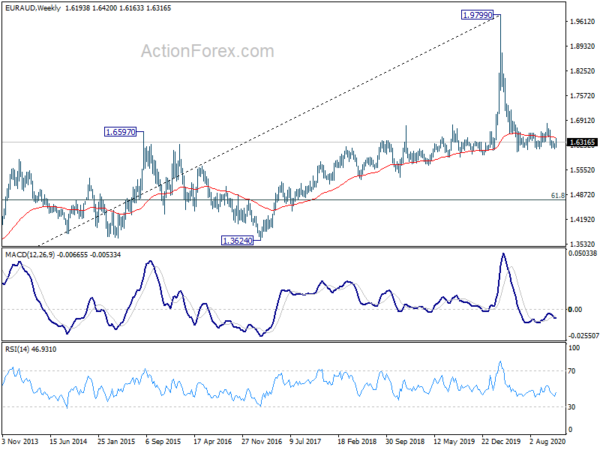

In the bigger picture, price action from 1.9799 are seen as developing into a corrective pattern. The question is whether it’s a sideway pattern or a deep correction. On the downside, sustained break of 1.6033 will suggest it’s the latter case and target 61.8% retracement of 1.1602 (2012 low) to 1.9799 at 1.4733. On the upside, break of 1.6827 resistance will favor the former case and bring stronger rebound.

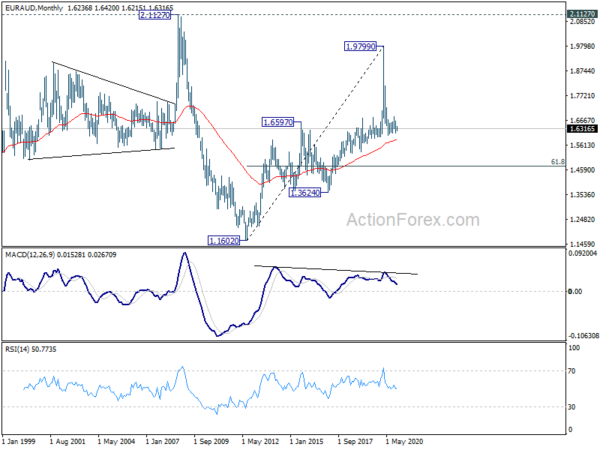

In the longer term picture rise from 1.1602 (2012 low) could have already completed with three waves up to 1.9799. The development suggests that long term range trading is extending with another medium term down leg. Sustained trading below 55 month EMA (now at 1.5855) will further affirm this case and target 1.1602/3624 support zone.