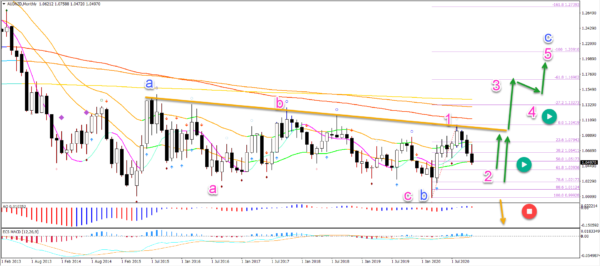

AUD/NZD has been in range for more than 5 year on the monthly chart. Price is now showing a potential bearish breakout with 100-300 pips space.

It remains likely that price action will move lower to test at least the 61.8% Fib at 1.04 if not the 78.6% Fibonacci retracement level at 1.0220 on the monthly chart.

But the Fibonacci levels could also act as support zones… Let’s review the monthly and 4 hour charts.

Price Charts and Technical Analysis

The AUD/NZD seems to be building a large ABC (blue) pattern. Although this wave outlook is fragile to the choppy consolidation zone.

If a larger wave C (blue) does occur, then price is expected to make a bullish bounce at the Fibonacci retracement levels. Price should also break above the resistance trend line (orange) if a 5 wave pattern emerges (pink).

A break below the bottom invalidates (red circle) the bullish outlook. This confirms a bearish breakout below the range and also a full downtrend.

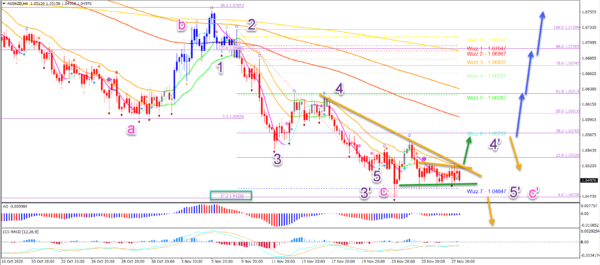

On the 4 hour chart, price could have completed a wave 5 (purple) of a larger ABC (pink) pattern at the -27.2% Fibonacci target (green box) and 50% Fib on the monthly chart.

But price action must break above the 21 ema zone and then the 38.2% resistance Fib to confirm that (blue arrows).

A bearish breakout below the support zone (green line) or a bearish bounce at the 38.2% Fibonacci zone could confirm the bearish outlook.

It remains likely that price action will move lower to test at least the 61.8% Fib at 1.04 if not the 78.6% Fibonacci retracement level at 1.0220 on the monthly chart. Also, the -61.8% Fibonacci targets form a confluence at 1.0310.