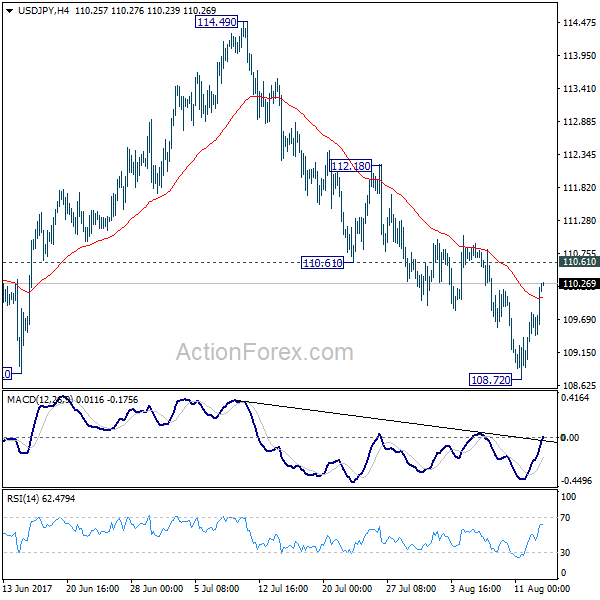

Daily Pivots: (S1) 109.18; (P) 109.48; (R1) 109.95; More…

USD/JPY’s rebound from 108.72 extends higher today. But it’s staying below 110.61 support turned resistance and intraday bias remains neutral. Near term outlook also stays bearish and deeper decline is expected. Firm break of 108.81 support will resume whole corrective fall from 118.65 and target 61.8% retracement of 98.97 to 118.65 at 106.48. However, break of 110.61 will indicate short term bottoming and turn bias back to the upside for 112.18 resistance and above.

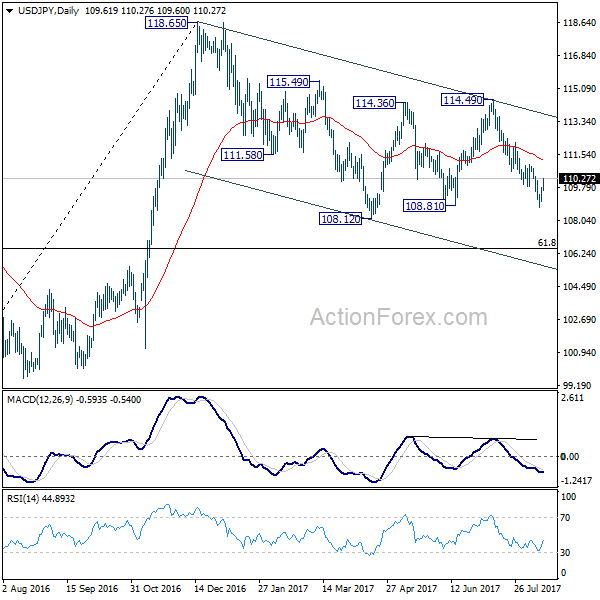

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, downside should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.