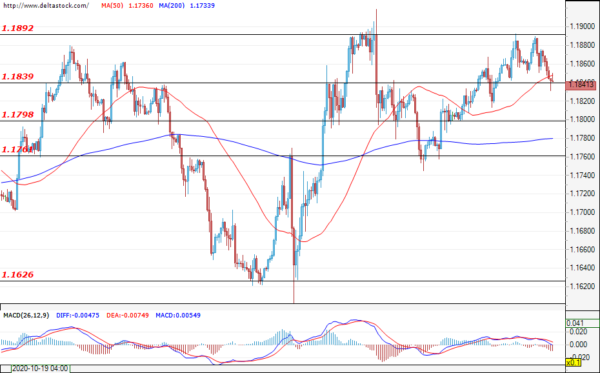

EUR/USD

Current level – 1.1841

At the time of writing the analysis, the currency pair is testing the support zone at 1.1840 after two unsuccessful attempts of breaching the resistance at 1.1892 since the beginning of the trading week. A successful breach of this support, could give an additional incentive for the bears to attack the next support level at 1.1798. The most important economic news for today, which could affect the market sentiment, is the data on Initial jobless claims for the U.S. (13:30 GMT), as well as the data on Existing home sales for the U.S. (15:00 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1892 | 1.1980 | 1.1840 | 1.1760 |

| 1.1920 | 1.2010 | 1.1800 | 1.1626 |

USD/JPY

Current level – 103.72

The sentiment remains negative after the bears managed to overcome the support zone at 104.18. The next target is the level of 103.20 and a successful violation of this level would further deepen the bearish sentiment, thus paving the way towards the next support located at around 102.00. In the positive direction, only a breach above the resistance level at 104.85 could reverse the market sentiment.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 104.18 | 104.85 | 103.20 | 102.20 |

| 104.43 | 105.45 | 103.07 | 102.20 |

GBP/USD

Current level – 1.3221

The bears managed to enter the market after the bulls failed to overcome the resistance at 1.3309. At the time of writing, the currency pair is testing the support zone at 1.3225, and it is possible to witness a deeper sell-off if the U.S. dollar manages to gain momentum. The next more significant support for the Cable is found at 1.3170, followed by the one at 1.3117.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3273 | 1.3309 | 1.3225 | 1.3117 |

| 1.3309 | 1.3400 | 1.3170 | 1.3021 |