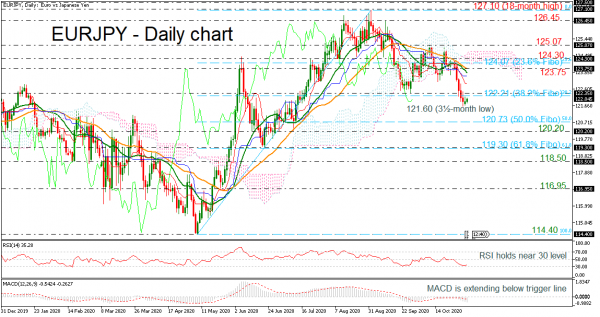

EURJPY was plunging for five consecutive negative days, dropping beneath the 38.2% Fibonacci retracement level of the up leg from 114.40 to 127.10 and the 122.00 handle. The price reached a fresh three-and-a-half-month low of 121.60 on Friday, while the 20- and 40-day simple moving averages are continuing the falling move.

Technically, the RSI indicator is pointing up around the 30 level, while the MACD is falling below the trigger line, extending its bearish structure. Moreover, the Ichimoku lines are endorsing the bearish outlook as the red Tenkan-sen line is standing below the blue Kijun-sen line in the short-term.

Should price continue the negative move, immediate support could come from the 50.0% Fibonacci of 120.73 and the 120.20 barrier. More losses could take the price further south, touching the 61.8% Fibonacci of 119.30.

Otherwise, a climb above the 122.35 resistance could meet the 20- and 40-day SMAs around the 123.75 barrier. Marginally above this level, the 23.6% Fibonacci of 124.07 and the 124.30 level could attract traders’ attention. Even higher, the way could open for the 125.07 line.

To sum up, EURJPY has been strongly negative in the short and medium-term timeframes. Only a decisive close above the 18-month peak could switch the outlook back to bullish in the longer picture.