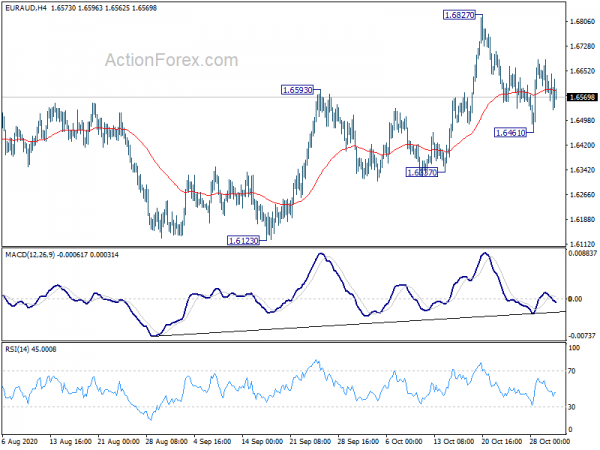

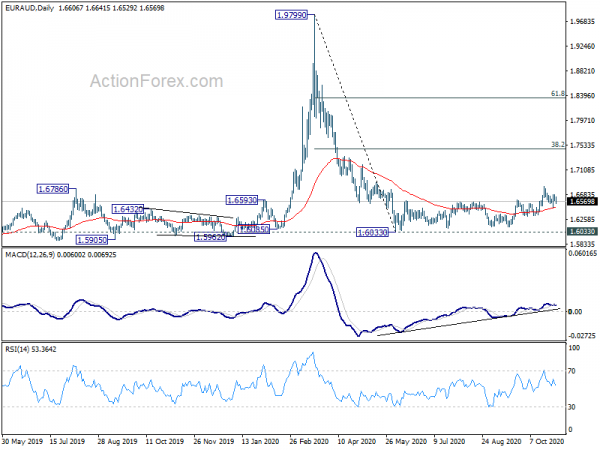

Despite slightly deeper than expected pull back to 1.6461, EUR/AUD rebounded well ahead of 1.6337 support. The development maintains near term bullishness. Initial bias remains neutral this week first. On the upside, firm break of 1.6827 will resume the corrective pattern from 1.6033. Next target is 38.2% retracement of 1.9799 to 1.6033 at 1.7472. However, break of 1.6461 will turn bias to the downside for 1.6337 support.

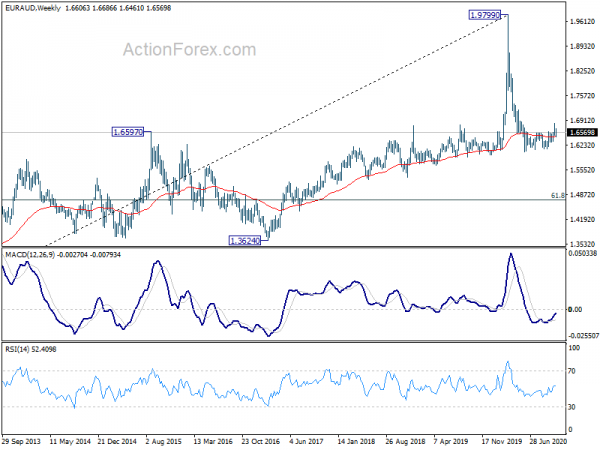

In the bigger picture, current development suggests that price actions form 1.9799 might be developing into a sideway pattern only. That is, medium term outlook is just neutral, and up trend from 1.1602 (2012 low) could resume at a later stage. On the downside, though, sustained trading below 55 week EMA (now at 1.6463) would revive medium term bearishness for 61.8% retracement of 1.1602 to 1.9799 at 1.4733.

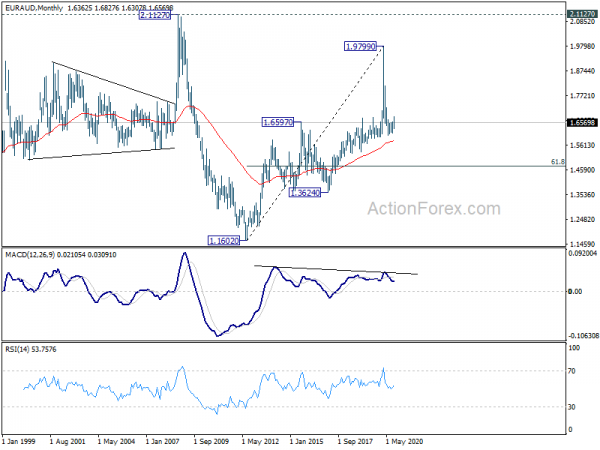

In the longer term picture rise from 1.1602 (2012 low) could have already completed with three waves up to 1.9799. The development suggests that long term range trading is extending with another medium term down leg. Sustained trading below 55 month EMA (now at 1.5816) will further affirm this case and target 1.1602/3624 support zone.