- Euro on the chopping block ahead of potential French lockdown

- Markets in a sour mood overall as Trump pulls ahead in Florida polls

- Stocks under heavy pressure, defensive yen shines

- Coming up: Central bank decisions in Canada and Japan

Euro finally wakes up to the risks

The single currency is taking heavy fire on Wednesday and European equity markets are a sea of red, as investors slash their exposure to euro-denominated assets ahead of a potential lockdown announcement in France. President Macron will address the nation later today and speculation is running rampant that he will enact a new lockdown to tackle the latest wave of coronavirus that is rampaging through the country.

Meanwhile, media reports suggest German Chancellor Merkel is also considering a ‘light’ shutdown, which would force the closure of bars, restaurants, and public events. The German covid numbers are still far lower compared to much of Europe, why the measures under consideration are also milder.

Still, this is dire news. Germany and France are the two largest economies in the Eurozone, with Italy and Spain at number three and four, so Europe’s ‘big four’ will now have to grapple with strict measures that will inevitably hit growth. The fear is that this time, the fiscal cavalry won’t ride to the rescue as public deficits have already ballooned, the EU recovery fund is stuck in the bureaucratic labyrinth, and there is simply less political appetite for massive stimulus if it is only a partial lockdown.

Overall, the risk that the economy contracts again in Q4 has risen dramatically. While the euro has declined already, especially against the yen, the risks remain to the downside as the Eurozone is about to be hit by a volley of growth downgrades and the ECB will likely prepare the ground for another liquidity dump at its meeting tomorrow. The only saving grace is that for now, US election and Brexit risks are also keeping the dollar and sterling under pressure, limiting the euro’s losses.

Covid and election worries keep markets on edge

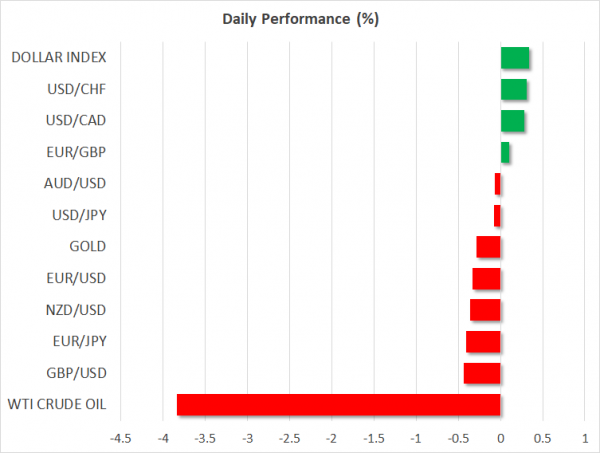

In the broader market, risk aversion is the name of the game. Wall Street is set to open more than 1% lower according to e-mini futures tracking the S&P 500, the dollar and yen are shining in the FX arena, and government bonds are back in fashion.

Besides concerns around the economic impact of the re-closures in Europe and the raging infection wave in the American Midwest, investors may also be on edge because of how much the US election race has narrowed. In a stunning reversal, President Trump has overtaken Joe Biden in the crucial battleground state of Florida according to the polling average compiled by RealClearPolitics, raising the odds both for a contested election and a divided Congress outcome.

Florida is the largest swing state in terms of electoral votes and the most important, as the candidate that won the Sunshine State has also taken the White House in every presidential race going back to 1964. Election uncertainty is therefore back with a vengeance, as the prospect of a sweeping Democratic victory that delivers king-sized stimulus packages no longer seems as likely.

BoC and BoJ in the spotlight

As for today, the main event will be the Bank of Canada meeting. The domestic economy is admittedly doing well, with core inflation accelerating and the unemployment rate falling in September. The only worrisome spot is that infections have spiked lately, but compared to most of Europe or America, Canada is still a covid oasis.

The Bank is therefore unlikely to act, so the market reaction might depend mostly on Governor Macklem’s tone. He may sound a tad cautious, highlighting the uncertainties ahead. If so, the loonie could spike slightly lower. But overall, what will truly drive the currency is how equity markets perform, as the correlation between the loonie and the S&P 500 has shot up lately, whereas the correlation with oil has fallen. Hence, the US election may be the single most crucial element.

The Bank of Japan also meets early on Thursday, though the yen hardly reacts to monetary policy decisions anymore. Instead, the haven currency will respond more to how global risk sentiment evolves.