Key Highlights

- GBP/USD started a major downside correction below 1.3100 and 1.3050.

- A crucial bullish trend line is forming with support near 1.2975 on the 4-hours chart.

- Crude oil price failed to clear the $41.50 resistance and declined below $40.00.

- The US Durable Goods Orders (to be released today) could increase 0.7% in Sep 2020, up from +0.5%.

GBP/USD Technical Analysis

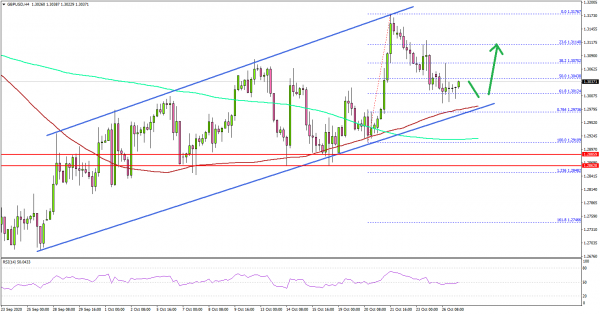

The British Pound started a major downside correction from the 1.3176 high against the US Dollar. GBP/USD traded below the 1.3100 support, but it is now approaching a few important support levels.

Looking at the 4-hours chart, the pair traded below the 50% Fib retracement level of the upward move from the 1.2910 swing low to 1.3176 high. There was also a close below the 1.3080 and 1.3060 support levels.

On the downside, the 1.3000 handle is a major support. There is also a crucial bullish trend line forming with support near 1.2975 on the same chart. The trend line coincides with the 100 simple moving average (red, 4-hours), and the 76.4% Fib retracement level of the upward move from the 1.2910 swing low to 1.3176 high.

The next major support is near the 1.2910 zone and the 200 simple moving average (green, 4-hours). As long as the pair is above the trend line support and the 100 SMA, it could start a fresh increase.

On the upside, an initial resistance is near the 1.3080 level. The first major resistance is near 1.3100, above which GBP/USD might rise towards the 1.3175 and 1.3200 levels.

Looking at EUR/USD, the pair also corrected lower, but it is trading nicely above the 1.1750 support. On the other hand, crude oil price failed to hold a major support and extended its decline below $39.00.

Upcoming Economic Releases

- US Housing Price Index for August 2020 (MoM) – Forecast +0.6%, versus +1.0% previous.

- US Durable Goods Orders for Sep 2020 – Forecast +0.7% versus +0.5% previous.

- US Nondefense Capital Goods Orders Excluding Aircraft for Sep 2020 – Forecast +0.5% versus +1.9% previous.