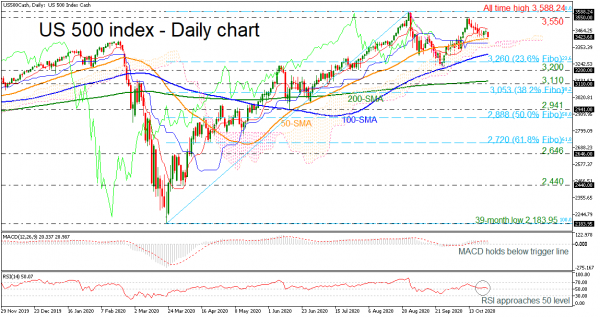

The US 500 index has reversed back down after finding resistance at the 3,550 level. This top is just below the all-time high of 3,588.24 that was reached on September 1. The momentum indicators are pointing to a neutral to negative bias in the short term with the RSI just above 50 and the MACD oscillator falling beneath its trigger line in the positive territory.

Further losses should see the 40-day simple moving average (SMA) at 3,408 acting as major support around the upper surface of the Ichimoku cloud at 3,394 and the blue Kijun-sen line. A drop below these levels could reinforce the bearish correction towards the 200-day SMA at 3,302 and the 23.6% Fibonacci retracement level of the up leg from 2.183.95 to 3,588.24 at 3,260. Further losses could see the 3,200 handle challenged, ahead of the 100-day SMA and 3,110.

In the event of an upside reversal, the 3,550 could act as a barrier before being able to re-challenge the all-time high of 3,588.24. A break above this level would shift the short-term outlook back to strongly bullish, flirting with the 3,818.75 barrier, being the 161.8% Fibonacci extension level of the down leg from 3,588.24 to 3,200.

Overall, the US 500 index has been in a minor negative short-term move, but the long-term picture remains positive.