Key Highlights

- EUR/USD found support near 1.1780 and started a fresh increase.

- A crucial rising channel is forming with support near 1.1740 on the 4-hours chart.

- The US Manufacturing PMI increased from 53.2 to 53.3 in Oct 2020 (Preliminary).

- The German IFO Business Climate Index could decline from 93.4 to 92.7 in Oct 2020.

EUR/USD Technical Analysis

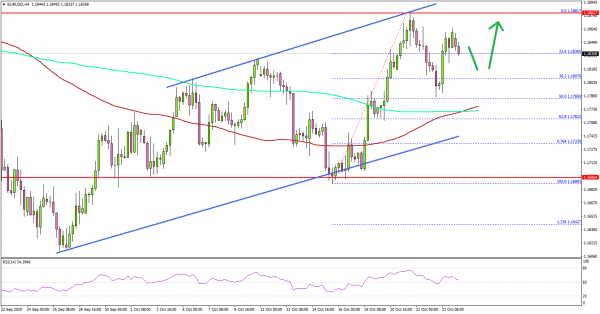

The Euro started a short-term downside correction from the 1.1880 resistance against the US Dollar. EUR/USD traded below 1.1820, but it found support near the 1.1780 zone.

Looking at the 4-hours chart, the pair tested the 50% Fib retracement level of the upward move from the 1.1688 low to 1.1881 high. It also remained well bid above 1.1750, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

More importantly, there is a crucial rising channel forming with support near 1.1740. The pair is currently rising and showing positive signs above the 1.1800 level.

The main resistance on the upside is still near 1.1880, above which the pair could accelerate higher towards the 1.1920 level. The next major resistance is near the 1.1950.

If there is a downside correction, the 1.1800 level is an initial support. The main support seems to be forming near the channel support, 1.1750, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

Fundamentally, the US Manufacturing Purchasing Managers Index (PMI) (Prelim) for Oct 2020 was released this past Friday by the Markit Economics. The market was looking for an increase from 53.2 to 53.4.

The actual result was close to the forecast, the US Manufacturing PMI increased from 53.2 to 53.3 in Oct 2020. Besides, the US Services PMI increased sharply from 54.6 to 56.0.

Overall, EUR/USD could accelerate higher once it clears the 1.1880 resistance. Conversely, GBP/USD is struggling to stay above 1.3020 and it could correct further lower.

Upcoming Economic Releases

- German IFO Business Climate Index Oct 2020 – Forecast 92.7, versus 93.4 previous.

- US New Home Sales for Sep 2020 (MoM) – Forecast +3.9% versus +4.8% previous.