Risk aversion remains the main theme in the markets. Commodity currencies remain the weakest ones while Yen is staying firm. Dollar trades mildly higher but there is no follow through buying yet. RBNZ rate decision triggered a brief recovery in New Zealand Dollar but Kiwi is quickly back under pressure. Selloff in stocks seem to have stabilized though, with Nikkei hovering in tight range in red today, down around -0.15%. Gold is hovering between 1280/5 after yesterday’s rally and is waiting for fresh inspiration. US-North Korea tension will remain the main focus today while data from UK and US will catch most attention.

RBNZ left OCR unchanged at 1.75% as widely expected

As expected, the RBNZ left the OCR unchanged at 1.75%. Governor Wheeler reiterated that the monetary policy would remain accommodative for some time. The staff projection continued to forecast the first rate hike to come in 2H19. They also revised lower the short term inflation outlook and intensified the warning that a lower currency is needed for growth. NZD/USD jumped to a 3-day high of 0.7371 after the announcement, but gains were erased afterwards. At the time of writing NZD/USD has already resumed recent fall from 0.7553 and reaches as low as 0.7298. More in RBNZ Left Policy Stance Unchanged, Heightened Warning Over NZD Strength.

Chicago Fed Evans: December hike is a subject for discussion

Chicago Fed President Charles Evans said that it’s "quite reasonable" to start unwinding Fed’s balance sheet in September even "with potentially temporary lower inflation data". Nonetheless, the matter of one more rate hike in December is a subject for discussion. He noted that if you thought that inflation was weaker and we needed more accommodation you could decide to put that off until later." He emphasized that the longer inflation stays below 2% target, "it creates a few more problems". And, "I’d like to see a little more evidence that we are actually getting to 2 percent sooner rather than later."

North Korea finalizing plan to strike Guam in mid-August

The tensions between US and North Korea continue to intensify. North Korea responded to US President Donald Trump’s "fire and fury" warning and said that Trump "again let out a load of nonsense about ‘fire and fury,’ failing to grasp the on-going grave situation". And Pyongyang also said that "sound dialogue is not possible with such a guy bereft of reason and only absolute force can work on him." Meanwhile, North Korean also said that it’s finalizing the plans for missile launches near Guam by mid-August.

On the other hand, it’s reported that Trump didn’t consult with Secretary of State Rex Tillerson before making his "fire and fury" warning. White House press secretary Sarah Huckabee Sanders said that the national security team was "well aware of the tone of the statement of the president prior to the delivery". But the words that Trump used "were his own".

Elsewhere

Japan machine orders dropped -1.9% mom in June while domestic CGPI rose 2.6% yoy in July. Australia inflation expectation slowed to 4.2% in August. UK RICS house price balance dropped to 1 in July.

UK data are the main focuses in European session. Industrial production, manufacturing production, construction output and trade balance will be released. From US jobless claims, PPI will be featured. Canada will release new housing price index.

AUD/USD Daily Outlook

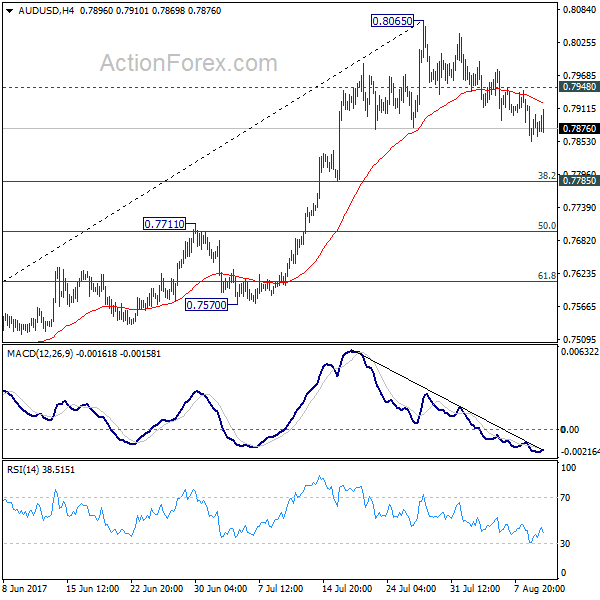

Daily Pivots: (S1) 0.7857; (P) 0.7885; (R1) 0.7916; More…

AUD/USD’s pull back from 0.8065 is still in progress and intraday bias stays on the downside. Deeper fall would be seen to 0.7785 cluster support (38.2% retracement of 0.7328 to 0.8065 at 0.7783). But we’d expect strong support there to bring rebound. Above 0.7948 minor resistance will turn bias back to the upside for retesting 0.8065. But decisive break there is needed to confirm rally resumption. Otherwise, we’d expect more consolidative trading in near term.

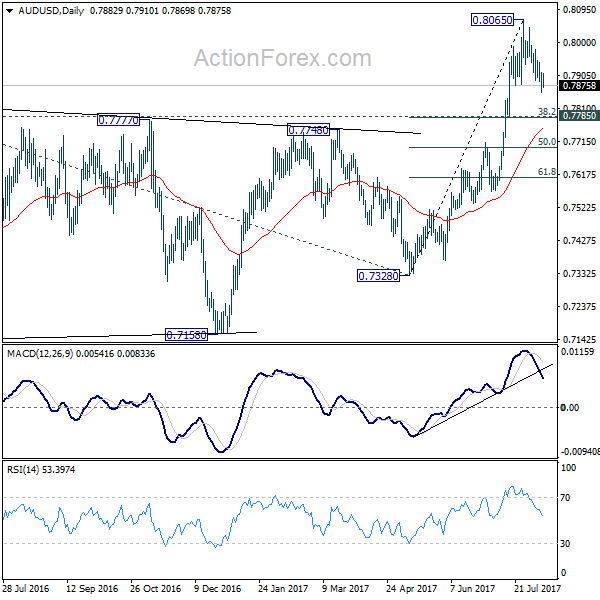

In the bigger picture, current development suggests that rebound from 0.6826 is developing into a medium term rise. There is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, break of 55 month EMA (now at 0.8100) will target 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7328 support is needed to confirm completion of the rebound. Otherwise, further rise is now expected.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:01 | GBP | RICS House Price Balance Jul | 1% | 9% | 7% | |

| 23:50 | JPY | Machine Orders M/M Jun | -1.90% | 3.70% | -3.60% | |

| 23:50 | JPY | Domestic CGPI Y/Y Jul | 2.60% | 2.30% | 2.10% | 2.20% |

| 1:00 | AUD | Consumer Inflation Expectation Aug | 4.20% | 4.40% | ||

| 4:30 | JPY | Tertiary Industry Index M/M Jun | 0.20% | -0.10% | ||

| 8:30 | GBP | Industrial Production M/M Jun | 0.10% | -0.10% | ||

| 8:30 | GBP | Industrial Production Y/Y Jun | -0.10% | -0.20% | ||

| 8:30 | GBP | Manufacturing Production M/M Jun | 0.00% | -0.20% | ||

| 8:30 | GBP | Manufacturing Production Y/Y Jun | 0.70% | 0.40% | ||

| 8:30 | GBP | Construction Output M/M Jun | 1.20% | -1.20% | ||

| 8:30 | GBP | Visible Trade Balance (GBP) Jun | -11.0B | -11.9B | ||

| 12:00 | GBP | NIESR GDP Estimate Jul | 0.30% | 0.30% | ||

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.50% | 0.70% | ||

| 12:30 | USD | Initial Jobless Claims (AUG 05) | 240K | 240K | ||

| 12:30 | USD | PPI M/M Jul | 0.10% | 0.10% | ||

| 12:30 | USD | PPI Y/Y Jul | 2.20% | 2.00% | ||

| 12:30 | USD | PPI Core M/M Jul | 0.20% | 0.10% | ||

| 12:30 | USD | PPI Core Y/Y Jul | 2.10% | 1.90% | ||

| 14:30 | USD | Natural Gas Storage | 20B | |||

| 18:00 | USD | Monthly Budget Statement Jul | -55.5B | -90.2B |