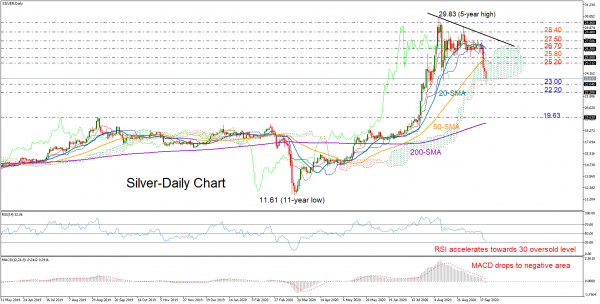

Sliver staged a dramatic decline of 12% this week after failing to close above the 20-day simple moving average (SMA). The sell-off has also pushed the price below the 50-day SMA and near the bottom of the Ichimoku cloud for the first time in three months, bringing the case for a downtrend forward.

The momentum indicators are painting a gloomier short-term picture as well. The MACD has extended its weakness into the negative area, while the RSI is forcefully falling towards its 30 oversold level.

Should the 23.00 level give way, the bears may need to remove the 22.20 support in order to pick up steam towards the 19.63 key area.

On the flip side, failure to close below 23.00 may generate upside pressures towards the 25.20-25.80 zone, where the 50-day SMA is currently hovering. Higher, the price may attempt to pierce the 20-day SMA and close above the 27.50 resistance region. A sustainable move above 28.00 may also be required for the commodity to rally towards its 5-year peak of 29.83.

In brief, silver may remain under bearish control in the near-term, with the sell-off expected to gain fresh momentum below the 23.00-22.20 region.