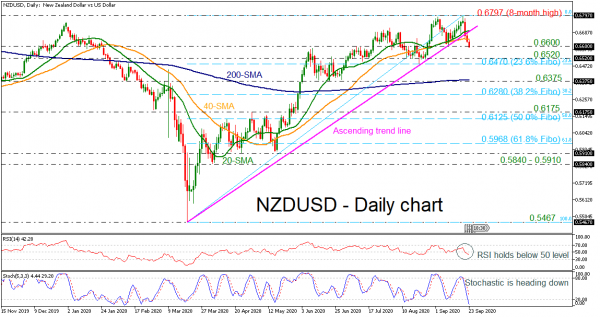

NZDUSD had a steep decrease over the previous couple of sessions, challenging the 0.6600 psychological level. The pair fell beneath the six-month ascending trend line, opening the way for a potential neutral bias in the short-term.

The momentum indicators are confirming the recent selling interest as the RSI slipped beneath its 50 level, while the stochastic oscillator dropped in the oversold zone. The 20- and 40-day simple moving averages (SMAs) are turning slightly lower and the 200-day SMA is flattening near the 0.6375 support level.

Hence, the short-run risk is looking neutral-to-negative at the moment and a decisive close below the 0.6600 round number might be what the bears are eagerly waiting for to push towards the 0.6520 level and the 23.6% Fibonacci retracement level of the up leg from 0.5467 to 0.6797 at 0.6470. Lower, the price may initially stall around the 200-day SMA at 0.6375.

To the upside, the 40- and then the 20-day SMAs at 0.6640 and 0.6697 respectively may add some footing to the market, but even a violation of the latter point may not attract much attention unless the price climbs towards the eight-month high of 0.6797. Positive momentum could further strengthen if this level is breached as well, with the 0.6940 – 0.6970 restrictive zone from March 2019 and December 2018 appearing next on the radar.

In brief, NZDUSD could trade neutral-to-negative in the short-term. A closure above the eight-month high could bring fresh buying pressure in the market, while a drop below the 200-day SMA could raise selling interest.