Key Highlights

- USD/JPY broke the key 105.20 support zone and extended its decline.

- Crude oil price started a strong recovery above $38.50 and $40.00.

- The US Initial Jobless Claims in the week ending Sep 12, 2020 declined from 893K to 860K.

- The Michigan Consumer Sentiment Index could increase from 74.1 to 75.0 in Sep 2020 (Prelim).

USD/JPY Technical Analysis

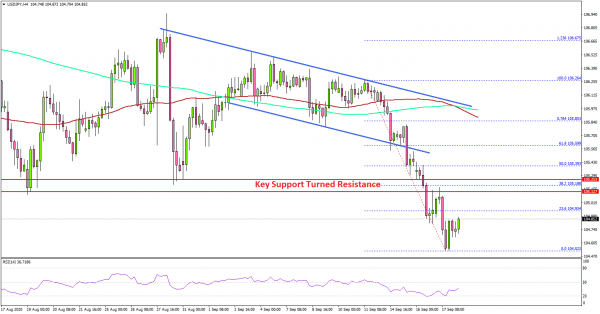

The US Dollar started following a declining pattern from well above 106.50 against the Japanese Yen. USD/JPY broke many key supports near 105.20 to move into a short-term bearish zone.

Looking at the 4-hours chart, the pair gained bearish momentum after it failed to clear a crucial bearish trend line at 106.26. There was a sharp decline, and the pair settled well below both the 200 simple moving average (green, 4-hours) and the 100 simple moving average (red, 4-hours).

The pair traded below the 105.20 and 105.00 support levels. It traded close to the 104.50 level and it is struggling to recover. On the upside, the pair is likely to face a strong resistance near the previous support zone at 105.20.

The main hurdle for the bulls is now forming near the 105.80 level and the 100 SMA. Conversely, the pair could continue to move down below the 104.50 level. The next major support could be 104.00.

Fundamentally, the US Initial Jobless Claims figure in the week ending Sep 12, 2020 was released yesterday by the US Department of Labor. The market was looking for a drop in claims from 884K to 850K.

The actual result was lower than the market forecast, as the US Initial Jobless Claims declined to 860K. The last reading was also revised up from 884K to 893K.

The report added:

The 4-week moving average was 912,000, a decrease of 61,000 from the previous week’s revised average. The previous week’s average was revised up by 2,250 from 970,750 to 973,000.

Overall, USD/JPY settled below many important supports and remains at a risk of more losses. On the other hand, crude oil price started a strong rally and it even climbed above $40.00. Looking at EUR/USD, the pair retested the key 1.1750 support level. Besides, GBP/USD is still facing hurdles near 1.3000.

Upcoming Economic Releases

- UK Retail Sales August 2020 (YoY) – Forecast +3.0%, versus +1.4% previous.

- UK Retail Sales August 2020 (MoM) – Forecast +0.7%, versus +3.6% previous.

- Michigan Consumer Sentiment Index Sep 2020 (Prelim) – Forecast 75.0, versus 74.1 previous.