In an otherwise quiet day in terms of market developments yesterday, two of the Fed’s most dovish policymakers, St. Louis Fed President James Bullard and Minneapolis Fed President Neel Kashkari stepped up to the rostrum. Both expressed their concerns regarding the recent low inflation readings. Given that Kashkari did not speak about policy much, we will focus on Bullard, who said he is unlikely to support any rate hikes in the near-term, as inflation is unlikely to rise much, even despite the tight US labor market. However, he pointed out that he is still ready “to get going” with a normalization of the Fed’s balance sheet (B/S) in September. Bullard is not a voter this year, but considering that he is usually ultra-dovish on policy, his comments suggest that even the most cautious FOMC officials may support a B/S action as early as September.

The dollar did not react much to these comments, possibly due to Bullard’s non-voting status. Even though we are not calling for a reversal in USD yet, we should point out that the short-USD trade is looking increasingly crowded to us. Fed rate expectations are already quite pessimistic, with markets pricing less than a 50% probability for another hike this year. Meanwhile, economic data have consistently surprised to the downside recently, while political developments (especially ones surrounding the White House) probably contributed to the USD’s underperformance as well. As such, we believe that further negative US news are likely to have a diminishing negative impact on the dollar, while any positive surprises could result in strong upside reactions. Leaving politics aside, a potential pick up in inflation over the coming months could lead to a significant repricing of Fed rate-hike expectations, and may thereby ignite a recovery in the dollar. Thus, we will pay close attention to the nation’s CPI data due out on Friday, for any signs as to whether the greenback’s fortune is likely to change anytime soon.

EUR/USD continued trading north on Monday and during the Asian morning Tuesday it tested the 1.1830 (R1) line as a resistance. The rate continues to trade above the short-term uptrend line taken from the low of the 22nd of June, which keeps the near-term picture positive, in our view. If the bulls manage to break the 1.1830 (R1) barrier, we expect them to target once again the 1.1900 (R2) hurdle. Nevertheless, a break above that obstacle is needed to confirm a higher high, something that could set the stage for more bullish extensions, perhaps towards our next resistance of 1.1980 (R3).

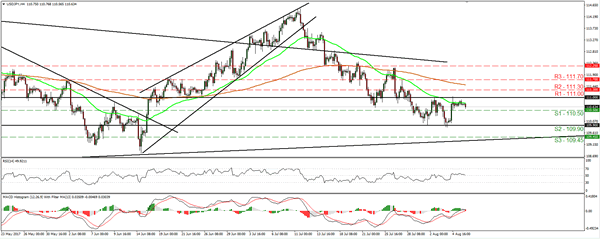

USD/JPY slid somewhat during the Asian morning Tuesday after it hit once again resistance slightly below the 111.00 (R1) zone on Monday. On the 28th of July, the pair has entered a sideways range between that barrier and the support of 109.90 (S2). As such, given that the latest retreat came after testing the upper bound of the aforementioned range, we would expect the slide to continue, at least within the range. A clear dip below the support of 110.50 (S1) may confirm the case and is possible to pave the way for the lower end of the range, at 109.90 (S2).

The economic calendar is light today as well:

The only indicators worth mentioning are Germany’s trade balance for June, and the US JOLTS job openings survey for June.

EUR/USD

Support: 1.1725 (S1), 1.1655 (S2), 1.1615 (S3)

Resistance: 1.1830 (R1), 1.1900 (R2), 1.1980 (R3)

USD/JPY

Support: 110.50 (S1), 109.90 (S2), 109.45 (S3)

Resistance: 111.00 (R1), 111.30 (R2), 111.70 (R3)