Yen rises broadly today as markets are awaiting Fed policy decision. The strength in Yen since last week seems to be related to inflation expectations. It first followed comments from an ECB official that the pandemic impact impact would eventually be demand dominate, and thus deflationary. Such view could be reflected in today’s Fed projections too. Thus, Yen somewhat decouples from risk sentiments for now and follows treasury yields lower. We’ll look at Yen’s reactions to FOMC later today and reassess. Staying in the currency markets, Sterling is actually the even stronger one, while Yen was only the second. Pull back in EUR/GBP is a factor helping the Pound. Dollar and Euro are the weakest.

Some suggested readings on Fed:

- FOMC Preview – Policy Incorporating Average Inflation Targeting. New Economic Forecasts and Dot Plots Awaited

- Fed Meeting: Justifying the Paradigm Shift

- FOMC Preview

- Fed Monitor: Forward Guidance Linked To Inflation Outcomes And Faster QE Buying On The Cards

- Powell Announced Dovish Shift to Fed’s Monetary Policy, Targeting Averaging Inflation and shortfall of Maximum Employment

- Powell Announces Changes to Monetary Policy Framework

- Fed’s Average Inflation Target Means Low Rates for Longer

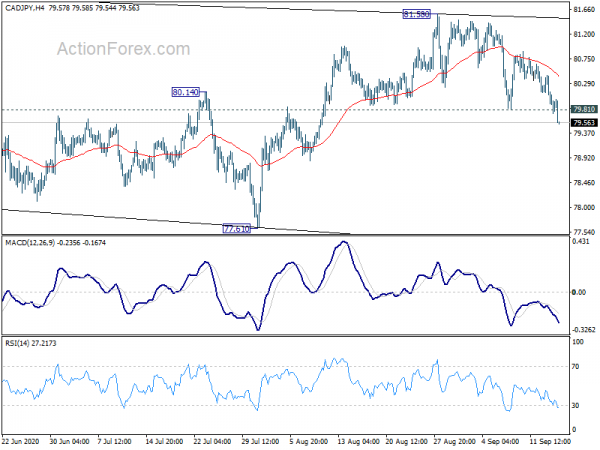

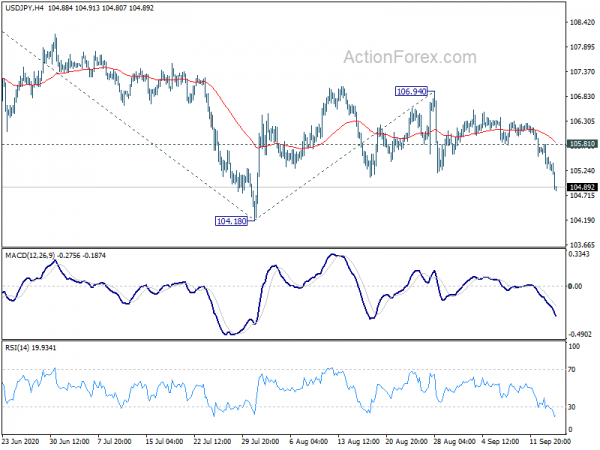

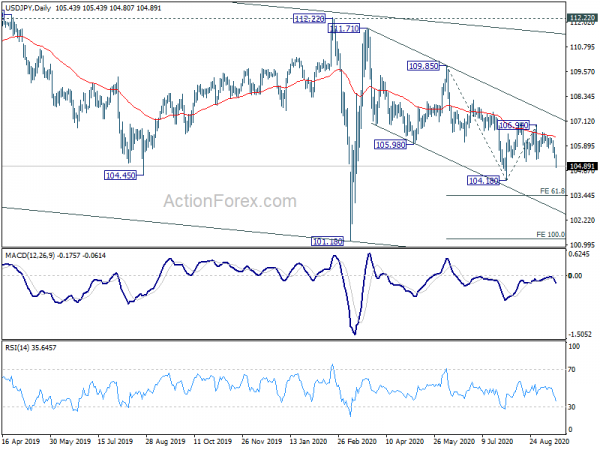

Technically, USD/JPY’s break of 105.10 should now bring a test on 104.18 low. Break will resume whole fall from 111.71. EUR/JPY also breaches 124.44 support which suggests that it’s finally correcting the whole rise from 114.42. CAD/JPY also breaks 79.81 support firmly and should be targeting 77.61 low. GBP/JPY is stubbornly holding on to 135.53 fibonacci support though.

In Europe, currently, FTSE is down -0.35%. DAX is up 0.07%. CAC is down -0.23%. German 10-year yield is down -0.018 at -0.495. Earlier in Asia, Nikkei rose 0.09%. Hong Kong HSI dropped -0.03%. China Shanghai SSE dropped -0.36%. Singapore Strait Times rose 0.78%. Japan 10-year JGB yield rose 0.0015 to 0.020.

US retail sales missed expectations, Canada CPI stalled

US retail sales rose just 0.6% mom to USD 537.5B in August, well below expectation of 1.1% mom. Ex-auto sales rose 0.7% mom, also below expectation of 1.1% mom. Total sales for June through August were up 2.4% yoy from the period a year ago.

Canada CPI was unchanged at 0.1% yoy in August, missed expectation of 0.5% yoy. CPI common rose to 1.5% yoy, up from 1.3% yoy, beat expectation of 1.4% yoy. CPI median was unchanged at 1.9% yoy, matched expectations. CPI trimmed was unchanged at 1.7% yoy, below expectation of 1.8% yoy.

Eurozone trade surplus widened in Jul, but exports and imports dropped double-digit over the year

Eurozone exports dropped -10.4% yoy in July to EUR 185.2B. Imports dropped -14.3% yoy in EUR 183.5B. Trade surplus widened to EUR 27.9B, comparing with EUR 23.2B a year ago. Intra-eurozone trade dropped to EUR 153.7B, down -8.6% yoy. In seasonally adjusted term, Eurozone exports rose 6.5% mom while imports rose 4.2% mom. Trade surplus rose to EUR 20.3B, up from June’s EUR 16.0B.

UK CPI slowed to 0.2% yoy, core CPI down to 0.9% yoy

UK CPI slowed sharply to 0.2% yoy in August, down from 1.0% yoy, but above expectation of 0.1% yoy. Core CPI dropped to 0.9% yoy, down form 1.8% yoy, also above expectation of 0.9% yoy. RPI dropped to 0.5% yoy, down from 1.6% yoy, below expectation of 2.2% yoy.

Also released, PPI input came in at -0.4% mom, -5.8% yoy, versus expectation of 1.3% mom, -4.3% yoy. PPI output was at 0.0% mom, -0.9% yoy, versus expectation of -0.1% mom, -1.0% yoy. PPI core output was at 0.1% mom, 0.2% yoy, versus expectation of 0.0% mom, -0.2% yoy.

Suga won parliament approval as PM, key ministers stay in cabinet

The Japanese Lower House of Parliament approved the appointment of Yoshihide Suga as the new Prime Minister. Roughly half of Shinzo Abe’s ministers remained in Suga’s cabinet. Taro Aso remains as Finance Minister and Toshimitsu Motegi kept his job as Foreign Minister. Also, Yasutoshi Nishimura stays as Economy Minister while Trade and Industry Minister Hiroshi Kajiyama also retains his post.

The signals are clear that Suga is going to continue with Abenomics and presses ahead with the reforms. Though, a new term “Suganomics” emerged as eventually, Suga is going to make his own marks, as least in some of the policy mix.

Japan exports had 8th straight month of double-digit decline in Aug

In non-seasonally adjusted term, Japan’s expected dropped -14.8% yoy to JPY 5232B in August. That’s the 8th straight month of double-digit decline, as well as the 21st month of contraction. It’s the worst run since the 23-month contraction through July 1987. Exports are generally expected to stay weak and might not reach pre-pandemic level until a least early 2022. Imports dropped -20.8% yoy to JPY 4984B. Trade surplus came in at JPY 248B.

In seasonally adjusted term, exports rose 5.9% mom to JPY 5580B. Imports rose 0.1% mom to JPY 5230B. Trade surplus widened to JPY 350B.

Australia Westpac leading index rose to -2.56, consistent with 4% growth in H2

Australia Westpac leading index rose to -2.56 in August, up from -4.42. Westpac said the improvement was broadly consistent with 1.8% growth in Q3, despite an expected -4% in the coronavirus center Victoria. That would also mean a “somewhat” moderated growth pace in Q4 at 2.2%. The combined second half growth would be 4%, more optimistic that RBA’s expectation of 1.3%.

Westpac also noted some market speculation surfaced after RBA minutes, for a rate cut from 0.25% to 0.1%. Such an option will “remain under considering but there appears to be no urgency”. RBA would indeed focus on supporting government bond markets first, including borrowing of state and territory governments.

OECD expects just -4.5% global contraction this year, US and China outlook revised up sharply

OECD revised up 2020 global GDP forecast, expecting to contract -4.5%, 1.5% higher than June’s single hit scenario. Both economic projections of US and China are revised up sharply higher. US economy is expected to contract -3.8% only, up by 3.5% from June. China is expected to grow 1.8%, up by 4.4% from June. Eurozone (at -7.9%, up by 1.2% from June), Japan (at -5.8%, up by 0.2%), UK at -10.1% (up by 1.4%) are just revised up slightly.

OECD said: “After collapsing in the first half of the year, economic output recovered swiftly following the easing of measures to contain the COVID-19 pandemic and the initial re-opening of businesses. Policymakers reacted rapidly and massively to buffer the initial blow to incomes and jobs. But the pace of recovery has lost momentum over the summer. Restoring confidence will be crucial to how successfully economies can recover, and for this we need to learn to safely live with the virus.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 105.23; (P) 105.52; (R1) 105.75; More...

USD/JPY’s sharp decline today suggests that corrective rise from 104.18 has completed and larger fall from 111.71 is resuming. Intraday bias is back on the downside for retesting 104.18 first. Firm break there will confirm and target 61.8% projection of 109.85 to 104.18 from 106.94 at 103.43 next. On the downside, though, above 105.81 minor resistance will dampen this bearish view and turn intraday bias neutral again first.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q2 | 1.83B | 0.69B | 1.56B | 1.90B |

| 23:50 | JPY | Trade Balance (JPY) Aug | 0.35T | -0.03T | 0.04T | |

| 00:30 | AUD | Westpac Leading Index M/M Aug | 0.50% | 0.10% | ||

| 06:00 | GBP | CPI M/M Aug | -0.40% | 0.40% | 0.40% | |

| 06:00 | GBP | CPI Y/Y Aug | 0.20% | 0.10% | 1.00% | |

| 06:00 | GBP | Core CPI Y/Y Aug | 0.90% | 0.70% | 1.80% | |

| 06:00 | GBP | RPI M/M Aug | -0.30% | 0.70% | 0.50% | |

| 06:00 | GBP | RPI Y/Y Aug | 0.50% | 2.20% | 1.60% | |

| 06:00 | GBP | PPI Input M/M Aug | -0.40% | 1.30% | 1.80% | |

| 06:00 | GBP | PPI Input Y/Y Aug | -5.80% | -4.30% | -5.70% | |

| 06:00 | GBP | PPI Output M/M Aug | 0.00% | -0.10% | 0.30% | |

| 06:00 | GBP | PPI Output Y/Y Aug | -0.90% | -1.00% | -0.90% | |

| 06:00 | GBP | PPI Core Output M/M Aug | 0.10% | 0.00% | -0.10% | |

| 06:00 | GBP | PPI Core Output Y/Y Aug | 0.20% | -0.20% | 0.10% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 20.3B | 17.3B | 17.1B | |

| 12:30 | USD | Retail Sales M/M Aug | 0.60% | 1.10% | 1.20% | |

| 12:30 | USD | Retail Sales ex Autos M/M Aug | 0.70% | 1.10% | 1.90% | |

| 12:30 | CAD | Foreign Securities Purchases (CAD) Jul | -8.52B | 10.50B | -13.52B | |

| 12:30 | CAD | CPI M/M Aug | -0.10% | 0.40% | 0.00% | |

| 12:30 | CAD | CPI Y/Y Aug | 0.10% | 0.50% | 0.10% | |

| 12:30 | CAD | CPI Common Y/Y Aug | 1.50% | 1.40% | 1.30% | |

| 12:30 | CAD | CPI Median Y/Y Aug | 1.90% | 1.90% | 1.90% | |

| 12:30 | CAD | CPI Trimmed Y/Y Aug | 1.70% | 1.80% | 1.70% | |

| 14:00 | USD | Business Inventories Jul | 0.20% | -1.10% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 78 | 78 | ||

| 14:30 | USD | Crude Oil Inventories | 2.1M | 2.0M | ||

| 18:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |