Key Highlights

- Gold price recovered above the $1,940 and $1,950 resistance levels.

- There was a break above a key bearish trend line at $1,960 on the 4-hours chart of XAU/USD.

- Crude oil price seems to be consolidating losses above the $36.50 support region.

- The Fed Interest Rate Decision will be announced today (forecast – no change from 0.25%).

Gold Price Technical Analysis

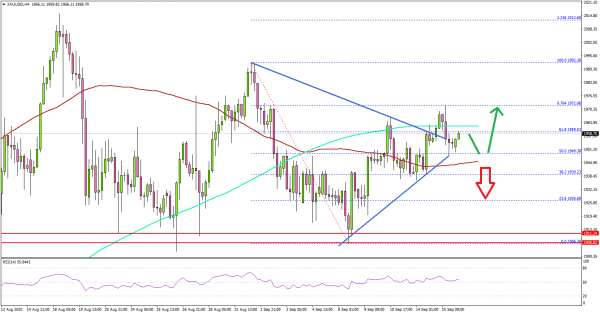

After retesting the $1,910 support, gold price started a fresh increase against the US Dollar. The price recovered above the $1,940 and $1,950 resistance levels to move into a short-term positive zone.

The 4-hours chart of XAU/USD indicates that the price was able to clear a key bearish trend line at $1,960. More importantly, there was a close above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The price even broke the 61.8% Fib retracement level of the downward move from the $1,990 high to $1,906 low. On the upside, the price is facing hurdles near $1,975.

A successful close above the $1,975 level could open the doors for a push towards the $1,995 and $2,000 resistance levels. Conversely, the price might correct lower below the $1,950 support.

On the downside, there is strong support forming near the $1,945 level and the 100 simple moving average (red, 4-hours). Any further losses could lead the price back towards the $1,910 support.

Looking at EUR/USD, the pair remained above the 1.1850 support level. GBP/USD is correcting higher, but it is likely to struggle near 1.3000 (as discussed in yesterday’s analysis).

Economic Releases to Watch Today

- UK Consumer Price Index August 2020 (YoY) – Forecast 0%, versus +1.0% previous.

- UK Core Consumer Price Index August 2020 (YoY) – Forecast +0.6%, versus +1.8% previous.

- Canadian Consumer Price Index August 2020 (MoM) – Forecast +0.1%, versus 0% previous.

- Canadian Consumer Price Index August 2020 (YoY) – Forecast +0.4%, versus +0.1% previous.

- US Retail Sales August 2020 (MoM) – Forecast +1%, versus +1.2% previous.

- Fed Interest Rate Decision – Forecast 0.25%, versus 0.25% previous.