August economic data released from China today were generally better than expected. Industrial production continued its bounce and rose 5.6% yoy versus expectation of 5.1% yoy. That’s also the fastest rise in eight months. Retail sales rose 0.5% yoy versus expectation of 0.0% yoy. Sales were finally growth after a seven-month downturn. Fixed asset investment dropped -0.3% ytd yoy, above expectation of -0.5% ytd yoy.

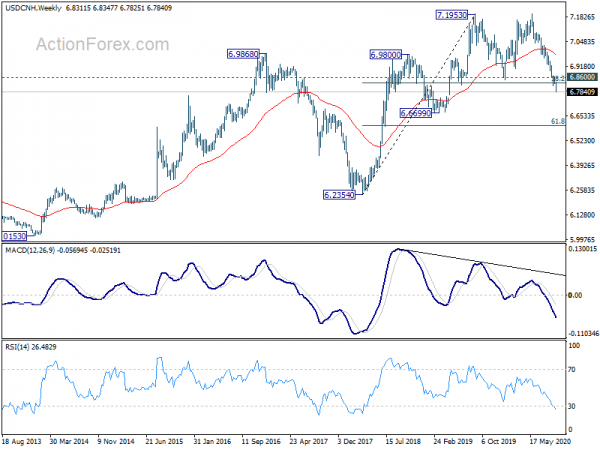

Yuan’s exchange rate appreciated on optimism that China’s economy is now on firm footing for further bounce back for the rest of the year. USD/CNH resumed the fall from 7.1961 and hits as low as 6.7825 so far. Outlook will stay bearish as long as 6.8600 resistance holds. The firm break of 38.2% retracement of 6.2354 to 7.9153 at 6.8286 now argues that whole rise from 6.2354 has completed already. Deeper fall would be seen to 61.8% retracement at 6.6021. Though, the reaction from Chinese stocks is so far mild. We’re prefer to see the SSE (now at around 3288) to break through the key resistance zone of 3500 to further confirm the underlying strength in sentiments.