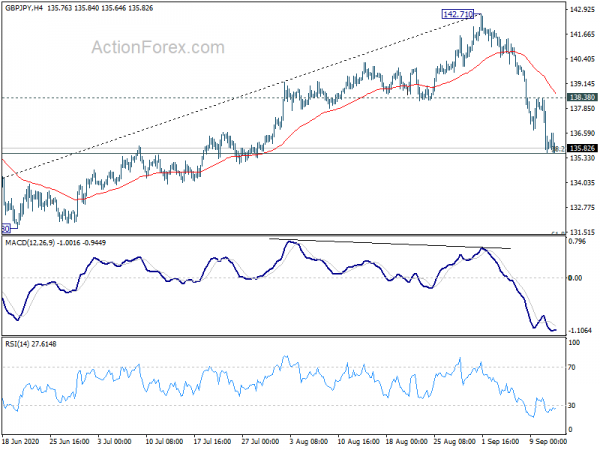

GBP/JPY’s decline from 142.71 accelerated lower last week. Initial bias stays on the downside this week first. Sustained break of 38.2% retracement of 123.94 to 142.71 at 135.53 will suggest that whole rebound from 123.94 has completed. Deeper fall could then be seen to 61.8% retracement at 131.11 next. Though, strong rebound from current level, followed by break of 138.38 minor resistance, will turn bias back to the upside for retesting 142.71 instead.

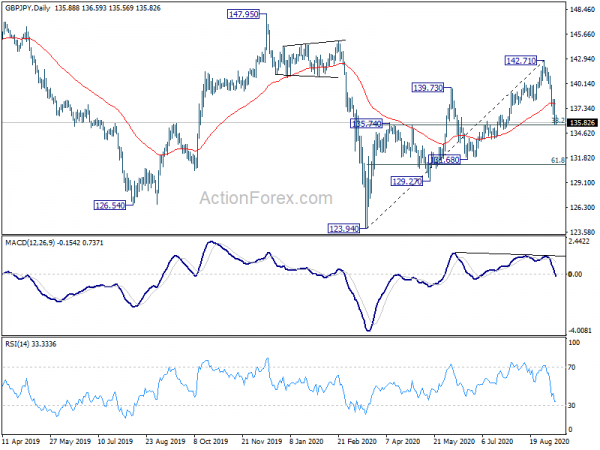

In the bigger picture, rise from 123.94 is still seen as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.

In the longer term picture, repeated rejection by 55 month EMA indicate long term bearishness in the cross. Down trend from 251.09 (2007 high) should eventually resume through 122.75 to 116.83 (2011 low) and below. However, sustained break of 55 month EMA (now at 144.65) will dampen this view and could open up further rise back to 195.86 (2015 high).