Key Highlights

- EUR/USD climbed sharply after tagging the 1.1765 support region.

- There was a break above a key bearish trend line with resistance near 1.1835 on the 4-hours chart.

- GBP/USD traded to a new monthly high and it broke the 1.3320 resistance.

- The German CPI could increase 0.2% in August 2020 (YoY) (Prelim), up from the last -0.1%.

EUR/USD Technical Analysis

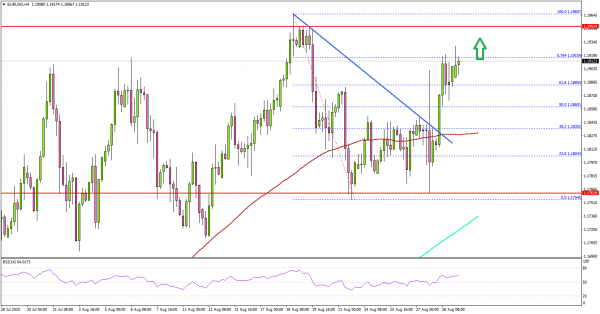

This past week, the Euro remained well bid above the 1.1765 and 1.1750 levels against the US Dollar. Recently, EUR/USD started a sharp rise and broke a few key hurdles near 1.1835.

Looking at the 4-hours chart, the pair gained bullish momentum after it surpassed the 1.1835 resistance and the 100 simple moving average (red, 4-hours). There was a break above the 50% Fib retracement level of the downward move from the 1.1965 high to 1.1754 swing low.

Moreover, there was a break above a key bearish trend line with resistance near 1.1835. The pair even traded above the 1.1880 resistance and it is now well above the 200 simple moving average (green, 4-hours).

On the upside, there is a strong resistance waiting near the 1.1950 and 1.1965 levels. It seems like EUR/USD could continue rise and it could break the last swing high near 1.1965 to register a new monthly high. GBP/USD already broke the last swing high near 1.3280 and traded to a new monthly high above 1.3350.

If EUR/USD fails to clear the 1.1950 resistance or 1.1965 high, it could start a fresh decrease. An initial support is near the 1.1835 level and the 100 SMA. Any further losses might push the pair back towards the 1.1765 support.

Looking at USD/JPY, the pair saw a heavy resistance near 107.00, resulting in a nasty decline below the 106.00 support.

Upcoming Economic Releases

- German CPI for August 2020 (YoY) (Prelim) – Forecast +0.2%, versus -0.1% previous.

- German CPI for August 2020 (MoM) (Prelim) – Forecast -0.2%, versus -0.5% previous.